Statewide Catastrophe Is Coming

spontaneous said:

Bernie Madoff is in jail. Put every NJ Governor who didn't fund the pension system (i.e. scammed the workers out of their pension) in jail and I'll agree with your analogy.

If it were only up to the SEC Madoff would not only be free but probably on the short list for Secretary of the Treasury now. What tripped him up was a combination of bad luck and not being able to appoint his judges, which NJ governors don't have to worry about..

Whenever the matter of pensions and fiscal responsibility arises; two thoughts occur to me:

1). We elect fiscally irresponsible persons and then complain that the people we elected are fiscally irresponsible.

We have met the enemy, and he is us.

2). Can anybody imagine a day when (start the Twilight Zone music) a governor has to fire the State Police force, so the Governor can pay the retired State Police pension recipients?

TomR

jbken said:

spontaneous said:

Bernie Madoff is in jail. Put every NJ Governor who didn't fund the pension system (i.e. scammed the workers out of their pension) in jail and I'll agree with your analogy.

If it were only up to the SEC Madoff would not only be free but probably on the short list for Secretary of the Treasury now. What tripped him up was a combination of bad luck and not being able to appoint his judges, which NJ governors don't have to worry about..

I'm not sure I understand your point. Would you please elaborate?

TomR

Tom_R said:

jbken said:

spontaneous said:

Bernie Madoff is in jail. Put every NJ Governor who didn't fund the pension system (i.e. scammed the workers out of their pension) in jail and I'll agree with your analogy.

If it were only up to the SEC Madoff would not only be free but probably on the short list for Secretary of the Treasury now. What tripped him up was a combination of bad luck and not being able to appoint his judges, which NJ governors don't have to worry about..

I'm not sure I understand your point. Would you please elaborate?

TomR

The point is that the S.E.C. did and does very little in the way of investigations in preparation for prosecution. Eric Holder did less. After the 2008 debacle, no banksters or hedge fund managers went to prison. A couple of mid-level and low level schlubs ended in jail and that was it.

It will be even worse now that the G.O.P. wants to deregulate Wall Street.

Bernie Madoff's mistake was that most of the people he defrauded were rich. That ain't supposed to happen. They invested hundreds of thousands and even millions into his "fund." My advise, Tom, if you want to get rich, start a fund with a minimum of $25 per month and a maximum investment of $5,000. Promise consistent returns of 16% because the fund will invest in the new magic batteries that self-charge by separating hydrogen and oxygen from the moisture that naturally is in the air and then burning both in separate chambers in the batteries. These work even better when the humidity in the air is high.

Do not mail the prospectus to Short Hills, Grenwich, Ct., Hamptons, Aspen, Co., San Jose or Beverly Hills zip codes.

Tom, don't just thank me. Your thanks ain't worth "..it." Just send me 5% of your income from this venture.

FYI. This is on the catastrophe coming in TPAF alone.

The TPAF alone has an official unfunded liability of $50 billion and if the Treasurer lowered the Discount Rate again (as the accountants recommend), the unfunded liability would be even higher.

These debts are not payable.

https://burypensions.wordpress.com/2017/03/04/milliman-on-nj-tpaf/#more-10054

If the state reneges on pensions, what do you think will happen next time there's a contract negotiation?

our options would be -- a) pay higher salaries in the present or b) accept less qualified applicants for public jobs.

Is "renege" the same as insolvent (or in need of restructuring)?

I know states cannot go bankrupt. But they can be insolvent. Obviously, we could raise taxes so that they are even higher. Currently, NJ is in the top 10 of highest income tax rates among the states. See http://www.money-zine.com/financial-planning/tax-shelter/state-income-tax-rates/ NJ is within a 1/100 of a percent or 2/100% of being the second highest.

CA has a state income tax rate of 13.3% (roughly a 4.3% higher tax rate than runners up). IMHO, CA has many natural advantages that NJ does not have and thus it is unlikely NJ would be able to increase income taxes as much as CA has.Additionally, NJ property taxes are the highest in the nation. See https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/

Raising NJ taxes higher will likely create a competitive disadvantage for NJ (less jobs in NJ). Historically, NJ has been a low cost state compared to NY (this has been NJ's competititve advantage). Additionally, NY earners who reside in NJ, usually pay the bulk of their income tax to NYS.

I think it is time for austerity here in NJ. As there appear few other alternatives. It would be reprehensible if NJEA, and its minions, demand substantially more when NJ is in such financial rough shape (NJ pensions are projected to start going to negative cash flow in 2020). The NJEA has spent hundreds of millions of dollars on influence, politicking and influencing the NJ legislature over the last 20 years. The NJEA, the 800lb gorilla, is part of the problem.

Additionally, let's start taxing all those teachers' pensions (and other government workers) earned in NJ but now being paid to these retired NJ government employees who are now resident outside of NJ. Further, let's implement 10% withholding for NJ income taxes on monthly payments of NJ state pensions. When the pensioner files their NJ tax return they can get a refund.

tom said:

If the state reneges on pensions, what do you think will happen next time there's a contract negotiation?

Legally NJ can't cut the base pensions, but it can cut post-retirement health care. That, and a combination of tax increases, is my hope here. (the only gubernatorial candidate who supports this is Jack Ciattarelli)

I don't think NJ has a choice regarding making cuts to post-retirement medical. There is no plausible combination of tax increases that will bring in enough revenue to fully fund the pensions, especially if there is a bear market or recession. Even raising the top bracket to 10.75% would only bring in $600 million.

In the Great Recession NJ's revenue dropped by 19%. Just imagine another recession with half as big a drop and it would be a $3.55 billion annual loss for NJ (the budget for FY2018 is $35.5 billion).

I don't know how the pension funds will survive the next recession.

tom said:

If the state reneges on pensions, what do you think will happen next time there's a contract negotiation?

RealityForAll said:

....

Additionally, let's start taxing all those teachers' pensions (and other government workers) earned in NJ but now being paid to these retired NJ government employees who are now resident outside of NJ. Further, let's implement 10% withholding for NJ income taxes on monthly payments of NJ state pensions. When the pensioner files their NJ tax return they can get a refund.

Well, guess what, sweetheart? I collect a teacher's pension and it is taxed by the state and federal gub'mint. I will be taxed less next year because Chris exchanged the transportation fund tax for a lower tax on pension income. Thank you, Chris. The pension would be taxed by N.J. no matter where I lived because it was earned in New Jersey.

My Social Security income is taxed by the U.S. but not by the state.

Carry on.

Wow. The NYTimes is reporting about how bad a deal teacher pensions have become for all but the longest-serving teachers.

https://www.nytimes.com/interactive/2017/03/06/business/dealbook/state-teachers-pensions.html?_r=1

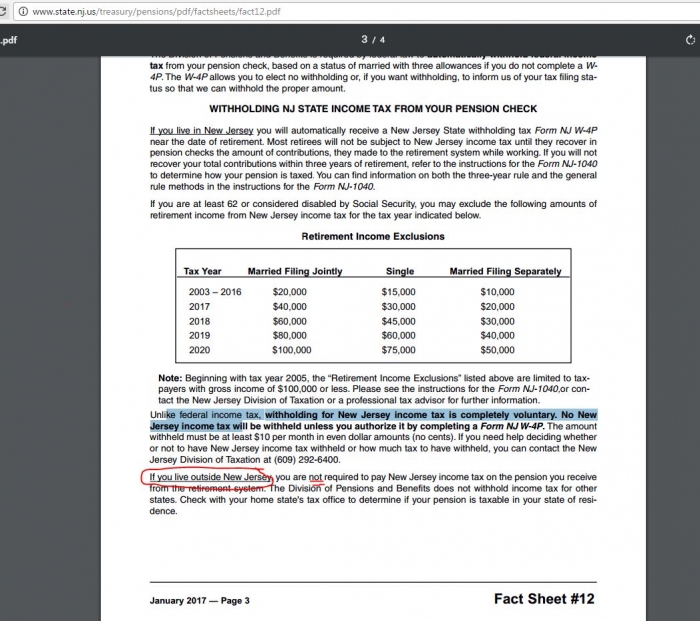

@FJJ, you may want to check the state of the law on NJ taxation of pensions paid by NJ to former NJ government employees (including school teachers). In your recent post you stated the following: "The pension would be taxed by n.j"="" target="_blank" rel="nofollow">N.J">N.J. no matter where I lived because it was earned in New Jersey" [emphasis added]. This is not the current state of NJ law. Currently, NJ does not tax pension payments to retired pensioners who are not resident in NJ. In addition, many states (such as FL, NH, TX and NV) have no personal income tax. And, many other states have significant exemptions for pensions paid to retirees (Tennessee comes to mind). Thus, retirees in these locations escape taxation at the state level by the state where the pension was earned (namely, NJ) and their resident state (a state other than NJ).

Many retirees (who are receiving NJ pensions) and living outside NJ are paying NIL ("$0.00") NJ income tax on these pensions benefits (despite these pensions being earned in NJ which is the nexus for taxation by NJ). In support of this fact, I am providing you with the following link from the NJ Division of Pension and Benefits: http://www.state.nj.us/treasury/pensions/pdf/factsheets/fact12.pdf See the last paragraph on page three ("3").

I have also attached a snip of the relevant page referenced above. Let me know your thoughts.

PS I am not partial to "sweetheart."

PPS It sound like your pension payments are taken into account when preparing your NJ income tax return BECAUSE YOU ARE RESIDENT IN NJ.

Formerlyjerseyjack said:

RealityForAll said:

....

Additionally, let's start taxing all those teachers' pensions (and other government workers) earned in NJ but now being paid to these retired NJ government employees who are now resident outside of NJ. Further, let's implement 10% withholding for NJ income taxes on monthly payments of NJ state pensions. When the pensioner files their NJ tax return they can get a refund.

Well, guess what, sweetheart? I collect a teacher's pension and it is taxed by the state and federal gub'mint. I will be taxed less next year because Chris exchanged the transportation fund tax for a lower tax on pension income. Thank you, Chris. The pension would be taxed by N.J. no matter where I lived because it was earned in New Jersey.

My Social Security income is taxed by the U.S. but not by the state.

Carry on.

Runner_Guy said:

Wow. The NYTimes is reporting about how bad a deal teacher pensions have become for all but the longest-serving teachers.

https://www.nytimes.com/interactive/2017/03/06/business/dealbook/state-teachers-pensions.html?_r=1

To be fair:

1. The article starts off by saying:

As teachers across the country retire, their pensions are being subsidized by newly hired teachers to a surprising degree. Teachers’ pension plans have always rewarded long-serving veterans at the expense of short-termers. But now, as more and more plans develop shortfalls, states have been imposing cost-cutting measures, and recent research shows that the newest hires are bearing the brunt of the changes, raising questions of fairness.

2. The article quotes one report, which is sponsored by the 3 conservative thinktanks:

- Teacherspensions.org

- Urban Institute

- Bellwether Education Partners (a charter school advocacy group)

3. The original report states the problem that "Most Teachers Gain Nothing from Their Pension Plans"

But... how can it be that most pensions are underfunded if most teachers will not earn in pensions as much as they put in??

It's possible this may be true for newer teachers (who are entering plans that have swung the pendulum to have new employees pay in more than they receive since the pension plans were underfunded by the state).

It seems the message should be how the states who underfunded the pensions are screwing their newer state employees in pensions. But instead the conclusions they are trying to make are that pensions are terrible because you can't get out of it as much as you put in.

It's incorrect logic to point fingers at the pension plan, rather than at the politicians who didn't put state money into it, and now want to pull more money from the working class.

http://apps.urban.org/features/SLEPP/

That said, this link from the article brings you to an interactive chart where NJ is the only state that has an "F" in state contributions across all breakouts of Plan by Occupation:

Click on:

- "Making Required Contributions":

Filter Plans by Occupation:

- All: (NJ, MA, ND, PA)

- General State Employees: (NJ, MA, ND, PA, TX, KY)

- General Local Employees: (NJ, ND, IL)

- Teachers: (NJ, MA, PA, CA, OH,)

- Firefighters & Police: (NJ, MA, PA, VA, OK,)

Sprout,

You have very good points here.

I admit I don't comprehend how new teachers in NJ would have to teach for 20 years before their pension pays off for them.

The contribution rate in NJ is 6.5%. If the average teacher salary is $61,000, that means the average teacher puts in $3965 per year.

Multiply that by 20 years and you get $79,300 in total contributions. If you factor in interest the real contributions should be seen as a few tens of thousands of dollars higher.

But then with the 20/60 calculation at a final average salary of $80k and you get a pension of $26,600 per year. (it's n/60 for Tier 4 and 5 employees in NJ)

At that size it should only take a few years for a teacher who had 20 years to get into positive returns.

If the teacher taught 15 years the contributions would be about $59k and the pension would be 15/60. The final average salary would be lower and the pension payout lower, but still it wouldn't take that long to get into positive territory.

So the study may be wrong with its claim as to when the crossover point is, but I assume the study is correct that new teachers in inferior tiers and short-career teachers heavily subsidize pensions for teachers in superior tiers and whose careers are longer.

The change in pension plans nationwide is a pretty huge failure of generational equity.

It's worth questioning the relevance of DB plans in an era when most employees change careers multiple times.

And for a teacher who will spend less than 10 years in the classroom and get $0 in a pension, a DB plan is pretty plainly worse than a DC plan.

sprout said:

Runner_Guy said:

Wow. The NYTimes is reporting about how bad a deal teacher pensions have become for all but the longest-serving teachers.

https://www.nytimes.com/interactive/2017/03/06/business/dealbook/state-teachers-pensions.html?_r=1

To be fair:

1. The article starts off by saying:

As teachers across the country retire, their pensions are being subsidized by newly hired teachers to a surprising degree. Teachers’ pension plans have always rewarded long-serving veterans at the expense of short-termers. But now, as more and more plans develop shortfalls, states have been imposing cost-cutting measures, and recent research shows that the newest hires are bearing the brunt of the changes, raising questions of fairness.

2. The article quotes one report, which is sponsored by the 3 conservative thinktanks:

- Teacherspensions.org

- Urban Institute

- Bellwether Education Partners (a charter school advocacy group)

3. The original report states the problem that "Most Teachers Gain Nothing from Their Pension Plans"

But... how can it be that most pensions are underfunded if most teachers will not earn in pensions as much as they put in??

It's possible this may be true for newer teachers (who are entering plans that have swung the pendulum to have new employees pay in more than they receive since the pension plans were underfunded by the state).

It seems the message should be how the states who underfunded the pensions are screwing their newer state employees in pensions. But instead the conclusions they are trying to make are that pensions are terrible because you can't get out of it as much as you put in.

It's incorrect logic to point fingers at the pension plan, rather than at the politicians who didn't put state money into it, and now want to pull more money from the working class.

RealityForAll said:

@FJJ, you may want to check the state of the law on NJ taxation of pensions paid by NJ to former NJ government employees (including school teachers). In your recent post you stated the following: "The pension would be taxed by n.j"="" target="_blank" rel="nofollow">N.J">N.J. no matter where I lived because it was earned in New Jersey" [emphasis added]. This is not the current state of NJ law. Currently, NJ does not tax pension payments to retired pensioners who are not resident in NJ. In addition, many states (such as FL, NH, TX and NV) have no personal income tax. And, many other states have significant exemptions for pensions paid to retirees (Tennessee comes to mind). Thus, retirees in these locations escape taxation at the state level by the state where the pension was earned (namely, NJ) and their resident state (a state other than NJ).

Many retirees (who are receiving NJ pensions) and living outside NJ are paying NIL ("$0.00") NJ income tax on these pensions benefits (despite these pensions being earned in NJ which is the nexus for taxation by NJ). In support of this fact, I am providing you with the following link from the NJ Division of Pension and Benefits: http://www.state.nj.us/treasury/pensions/pdf/factsheets/fact12.pdf See the last paragraph on page three ("3").

I have also attached a snip of the relevant page referenced above. Let me know your thoughts.

PS I am not partial to "sweetheart."

PPS It sound like your pension payments are taken into account when preparing your NJ income tax return BECAUSE YOU ARE RESIDENT IN NJ.

Formerlyjerseyjack said:

RealityForAll said:

....

Additionally, let's start taxing all those teachers' pensions (and other government workers) earned in NJ but now being paid to these retired NJ government employees who are now resident outside of NJ. Further, let's implement 10% withholding for NJ income taxes on monthly payments of NJ state pensions. When the pensioner files their NJ tax return they can get a refund.

Well, guess what, sweetheart? I collect a teacher's pension and it is taxed by the state and federal gub'mint. I will be taxed less next year because Chris exchanged the transportation fund tax for a lower tax on pension income. Thank you, Chris. The pension would be taxed by N.J. no matter where I lived because it was earned in New Jersey.

My Social Security income is taxed by the U.S. but not by the state.

Carry on.

I stand corrected on the taxation of out of state residents.

Regarding the voluntary withholding, that is true. One chooses to have money withheld from the pension check. However, the money is due to the state and federal treasuries on April 15th., regardless of whether it was withheld or paid in lump sum. The amount paid to the treasuries is "progressive" in that the retirees tax bill is included with other incomes and the total amount determines the tax bracket.

what is the big deal that pensioners aren't paying tax in NJ? They sell their homes to someone else who moves in and pays taxes. It's not like they abandon their homes and head to FL and leave an empty home behind to rot.

Runner_Guy said:

And for a teacher who will spend less than 10 years in the classroom and get $0 in a pension, a DB plan is pretty plainly worse than a DC plan.

Let's say one had a 401k from a 10 year position they left or retired from before the great recession with a nice chunk of change. Then it was decimated by the recession, with no more money going in so it can't really grow back afterwards.

Gambling one's contributions in the stock market can end up far worse than even.

so, your idea is to cut everyone's benefits by switching to a DC plan, which would also require the government to make contributions every year regardless of revenues (or simply stop contributing)

BIG DEAL: NJ source income (namely, pensions to retired NJ employees who have moved out of state) is NOT being taxed despite NJ being in dire financial straits.

IMHO, current law on taxation of NJ pensions paid to out-of-staters is bad policy and reduces tax revenues in a struggling state.

ml1 said:

what is the big deal that pensioners aren't paying tax in NJ? They sell their homes to someone else who moves in and pays taxes. It's not like they abandon their homes and head to FL and leave an empty home behind to rot.

The irony is that school districts will have to cut jobs because of the flat funding from the state. Does the NJEA think it's a good strategy to lose current jobs in order to pay for retirement obligations? This is not a viable long-term strategy.

Gilgul said:

This is the world we live in. All new spending will go to supporting pensions while everything else goes to hell.

http://www.nj.com/education/2017/03/how_much_state_aid_christie_proposed_for_every_nj.html#incart_river_home_pop

"About 85 percent of the state's 578 school districts won't see any increase in direct aid if Christie's final budget proposal doesn't change.

The flat funding for most districts comes even as Christie touted yet another record investment in education funding, 3.8 billion. The bulk of new education spending will go toward the teacher's pension and annuity fund or debt service payments, leaving districts to generate their own new revenue."

Runner_Guy said:

...

I don't think NJ has a choice regarding making cuts to post-retirement medical. There is no plausible combination of tax increases that will bring in enough revenue to fully fund the pensions, especially if there is a bear market or recession. Even raising the top bracket to 10.75% would only bring in $600 million.

.

At the candidates forum last week, Wisniewski took the position that the pensions don't need to be fully funded. As long as there is more money flowing in than flowing out, the system can remain stable.

I still don't get the issue. Money is fungible. A retiree moves out of state and another person moves in to take his or her place and pays taxes. Possibly more than a retiree would pay.

RealityForAll said:

BIG DEAL: NJ source income (namely, pensions to retired NJ employees who have moved out of state) is NOT being taxed despite NJ being in dire financial straits.

IMHO, current law on taxation of NJ pensions paid to out-of-staters is bad policy and reduces tax revenues in a struggling state.

ml1 said:

what is the big deal that pensioners aren't paying tax in NJ? They sell their homes to someone else who moves in and pays taxes. It's not like they abandon their homes and head to FL and leave an empty home behind to rot.

Maybe you can raise taxes and everybody doesn't move out of state.

http://www.huffingtonpost.com/carl-gibson/mark-dayton-minnesota-economy_b_6737786.html?

FilmCarp said:

dickf3 said:

BG9 said:

The fact is when money runs out the workers will get welshed. You can have massive tax increases to fund the pensions but as tjohn said then people will simply move and companies will move. A death spiral.

hoops said:

so if I understand this correctly Runner Guy wants to welsh on the promises made to these workers because demographics.

http://www.englishandculture.com/blog/bid/79522/Welsh-on-the-Deal-The-Danger-of-Negative-Stereotypes-in-Language

Some other examples cited in the above article include "Indian giver", "to jew someone down", and "to gyp someone".

I always thought the word was welch. Am I wrong?

Runner_Guy said:

So the study may be wrong with its claim as to when the crossover point is, but I assume the study is correct that new teachers in inferior tiers and short-career teachers heavily subsidize pensions for teachers in superior tiers and whose careers are longer.

The change in pension plans nationwide is a pretty huge failure of generational equity.

But if the conclusion is true that "new teachers are in inferior tiers", it knocks out the argument of the 'unions being an inflexible behemoth of power' as the problem in pension reform. It appears the unions have agreed to substantially worsen the pension terms for newer employees.

So, can we point fingers at the politicians who didn't fund the pensions now?

Yes, but if New Jersey's population were actually growing (instead of just flat-lining) our revenue and economy would grow much more rapidly than they are growing now. In order to become a healthy economy again, New Jersey has to do much better with the retention of retirees.

The states that have low debt:GDP ratios may have been more prudent than New Jersey, but they have the advantage of significantly growing economies that make their debts much easier to carry.

If your economy is growing, you can afford to make fiscal mistakes that a state or country with a stagnant economy can't make.

What gets called a "debt crisis" is often just as much an economic growth crisis.

ml1 said:

I still don't get the issue. Money is fungible. A retiree moves out of state and another person moves in to take his or her place and pays taxes. Possibly more than a retiree would pay.

RealityForAll said:

BIG DEAL: NJ source income (namely, pensions to retired NJ employees who have moved out of state) is NOT being taxed despite NJ being in dire financial straits.

IMHO, current law on taxation of NJ pensions paid to out-of-staters is bad policy and reduces tax revenues in a struggling state.

ml1 said:

what is the big deal that pensioners aren't paying tax in NJ? They sell their homes to someone else who moves in and pays taxes. It's not like they abandon their homes and head to FL and leave an empty home behind to rot.

Runner_Guy said:

Yes, but if New Jersey's population were actually growing (instead of just flat-lining) our revenue and economy would grow much more rapidly than they are growing now. In order to become a healthy economy again, New Jersey has to do much better with the retention of retirees.

(Just to be nitpicky): The population appears to still be growing, but the rate of growth is slowing:

Employment Wanted

Latest Jobs

Employment Wanted

-

On call house cleaning service

May 6, 2024 at 7:17pm

-

May 6, 2024 at 10:11am

-

Experienced Summer Nanny Available: Thursdays & Fridays ;)

May 6, 2024 at 8:56am

-

Brazilian cleaning 973 776 2481

May 5, 2024 at 7:35pm

-

May 5, 2024 at 11:14am

-

May 4, 2024 at 1:08pm

Help Wanted

-

CF583 PT Nanny for 2 (July Start)

May 7, 2024 at 2:07pm

-

May 7, 2024 at 7:32am

-

May 3, 2024 at 2:32pm

-

Cat Lovers - become part of our lovely Silver Hound Cat Sitter team

May 3, 2024 at 2:12pm

Lessons/Instruction

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

Thank you for posting this.

I agree that the disaster could have been prevented with better oversight. New York State's plans are in decent shape because they were always more locally funded than NJ's and localities had to obey the state, just like NJ's locally-funded plans are in decent shape for that reason.

New York State's own state-funded plans are in good shape too because in the early 1990s a judge required the State to make the annual normal cost of the pensions.

Although some states with well-funded plans have had it easy, since they have had so much economic growth. Wisconsin's plan actually puts a large amount of risk on pensioners too and allows automatic reductions in case of economic downturn. (this predates Walker).

Regarding Connecticut... I've started to follow CT politics because CT is similar to NJ, and yet has a progressive governor.

Connecticut's problem is that the hedge funds that pay a huge portion its taxes have no inherent reason to be there. It's not like they require proximity to natural resources or they have large sunk costs in Connecticut. If a hedge fund wants to move, relocating office furniture isn't that difficult.

CT became a hedge fund center because it had lower taxes than New York State. If its taxes were to exceed New York State's its competitive advantage would disappear. CT's taxes are already substantially higher than Massachusetts and many people in CT believe Massachusetts draws businesses away from them.

It's fascinating to me how Gov. Dannel Malloy of CT is refusing to raise income taxes now. He is slashing pension aid for affluent towns, and so will force substantial increases in property taxes, but he is now longer trying to raise any major Connecticut tax.

And in great contrast to Phil Murphy and John Wisniewski in NJ, Malloy is not publicly considering anything like a $15 an hour minimum wage or cuts to Connecticut's tax incentive program.

Malloy has been captured by reality.