NJ State Income Tax for Teleworkers

Tom_R said:

Source for the quoted material, please.

TomR

https://www.state.nj.us/treasury/taxation/covid19-payroll.shtml

How do rates compare?

I work in the city but have teleworked since last March. Going back every other day soon.

Always assumed that income tax rates were better in NJ than NYC. Am I incorrect?

Sep 2, 2021 at 5:15am Edited

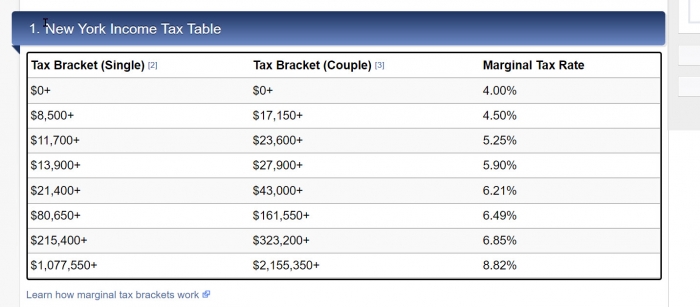

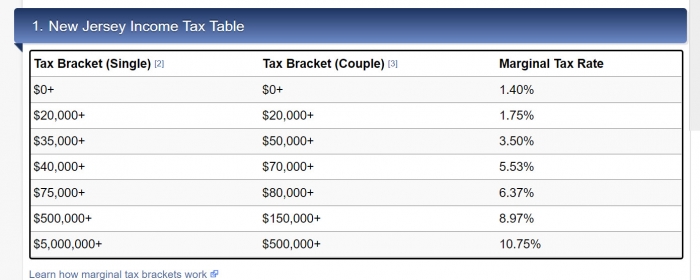

Assuming the following chart is correct, they are. But what you are allowed to deduct may also be different.

Not that the bracket amounts did not show up. They all show zero.

RTrent said:

For NJ

Thanks for doing the legwork. The two highest brackets for NJ look screwy though.

In order to add a comment – you must Join this community – Click here to do so.

For Sale

Free Items

Featured Events

-

Stephen Whitty Presents - Hometown Movie Stars: The Celebrated Actors Of CHS

May 6, 2024 at 7:00pm

NJ is notifying employers that teleworkers in NJ will have to pay income tax to NJ based on the days they work in NJ.

So, if you're employed in NY but are working in NJ you need to have your employer deduct withholding based on the number of days worked in NJ.

Example, if you work 75% in NJ and 25% in NY your employer needs to withhold NJ income tax based 75% of your NJ salary and NY income tax based on 25% of your NY salary. Normally working in NY gets 100% of your income tax withholding given to NY whereupon you what you paid to NY is then applied as a credit against your NJ income tax.

If you continue to pay your income tax to NY while working in NJ you will have underpaid your NJ income tax resulting in interest and penalties, if they catch you. Its the employers responsibility to correctly withhold. But its your responsibility to ensure the amounts of your income taxes remitted are correct.

Doing so helps NJ. NJ instead of NY will be getting your income tax money. Which is correct because some of you are working in NJ.

Its estimated that the waiver cost NJ about $1 billion a year.