John Ramos - Ex Super of Bridgeport CT choosen as new Super

Apr 12, 2015 at 3:39am Edited

nakaille said:

Yes, it is, mjh.

ETA: The curriculum needs to be beefed up, imo. My kid thought it was a boring joke for the most part.

My kids had same reaction but beefing up the curriculum is going to be pretty tough. It's hare to get adolescents excited about balancing a check book.

Apr 12, 2015 at 4:04am Edited

That's what I mean, David. It could be so much more, including learning about the stock market and investing in general. Teens are not adverse to learning how to make money in my experience. Macro-economics, micro-investing, social entrepreneurship, etc. With hands-on projects. Other districts do this and some kids find themselves starting up small corporations and figure out how to finance their own dreams early on.

In addition to a check book , maybe the class would make them think twice about the college they choose and the outrageous rates many have been lured into .

So many tweny and thirty someones are truly in a bind with loans that are so outrageous and unbelievably impossible to handle and few of these students cannot find a job in their chosen profession ...it's kind of u realistic for a social worker or teacher graduating to pay back loans of 40,000 or more.

It should be part of a finance class .

A good portion of the class should be doing more than balancing a check book - it should include the next decade and how that will be managed ...we had check book management in the eight grade ...and guidance counselors who counseled about affordable schools ...somewhere things have surely gotten off track.

Agreed that stocks etc should be part of this class ..teens would be more grounded as to the realities they will face or the realities they can alter given the proper info.and encouragement ..none of it should come as a shock upon high school graduation .

So many tweny and thirty someones are truly in a bind with loans that are so outrageous and unbelievably impossible to handle and few of these students cannot find a job in their chosen profession ...it's kind of u realistic for a social worker or teacher graduating to pay back loans of 40,000 or more.

It should be part of a finance class .

A good portion of the class should be doing more than balancing a check book - it should include the next decade and how that will be managed ...we had check book management in the eight grade ...and guidance counselors who counseled about affordable schools ...somewhere things have surely gotten off track.

Agreed that stocks etc should be part of this class ..teens would be more grounded as to the realities they will face or the realities they can alter given the proper info.and encouragement ..none of it should come as a shock upon high school graduation .

I'd start with the parents on that front before I horrify the kids with the information.

I don't know if it is only this district but I feel like we do a lot of checking off boxes and "settling" when it comes to classes which are not part of our push to reduce the achievement gap. Every hour of every day that a child sits in a classroom in front of a teacher is an opportunity and classes and curriculum that are not well thought out or unchallenging and boring or delivered poorly is a lost opportunity.

I understand that all classes can't be "exciting" but we need to do more than just checking off the boxes and use these classes to reach students more effectively and not squander these hours.

I understand that all classes can't be "exciting" but we need to do more than just checking off the boxes and use these classes to reach students more effectively and not squander these hours.

One tiny glimpse of the world our students are graduating into is found in this short article in The Atlantic:

http://www.theatlantic.com/business/archive/2015/04/where-do-firms-go-when-they-die/390249/?google_editors_picks=true

I copied the article below. A simple point, many kids want a career in something that interests them whether it be science, engineering, marketing, acting, music or education (and many, many more options). Other posters have mentioned that many are burdened with student loan debt and that opportunities are not all that plentiful in their chosen areas -- eg, while history is fascinating and I read a lot of it, it is very hard to get a job that uses history as history, eg, a history teacher. But one can use the study of history to be able to think long term about something else in a field that may also be of interest to a student of today. Corporations might find that having someone who is not enraptured by a piece of tech actually very useful as, to be blunt, much of what we see as tech today is fashion driven, not necessarily driven by utility.

But The Atlantic article (link above, article below) suggests that for the foreseeable future technology is shortening the lifetime of firms. I think the very nature of the corporation is under attack as technology allows for so many functions to be done by others -- look at Apple, a giant of a corporation loaded with wealth, so much wealth they do not know what to do with it. Apple is a true marketing machine. Its manufacturing is done by others; shipping by someone else. They design and package better than anyone. But once you leave the world of Apple and Google and look at smaller firms that are not the top of the heap in banking or tech, we see a different story -- careers will be hard to come by as firms come and go.

Your kids and mine may end up working for a pile of companies that go in and out of existence much like the virtual particles in the vacuum (that's a physics thing!). That transition has already occurred and many of us have already been through that. I think it will get only more difficult to stay with a company for many years. What goes along with that is a weakening of the social fabric supporting us all -- social security and medicare, pensions, even savings as banks have the penchant for risking a lot of money and periodically losing it all.

So I ask once again, what do we teach our kids now? The world of 2031 looks pretty scary to me and are we really going to give our kids the foundation for survival -- meaning establishing a career, being able to have a family and a home, live a good life -- when so much is in flux?

Here's the article (space may require it to be in two parts, this post and the next):

Where Do Firms Go When They Die?

Companies can't live forever, and the average lifespan of a publicly traded company is dropping. The good news is they become other companies.

BOURREE LAMAPR 12 2015, 8:00 AM ET

In the classic economic paper The Nature of the Firm, Nobel economist Ronald Coase wrote about why firms exist. Coase's argument was that firms lower the costs of producing goods and services, because it's easier to coordinate people and projects when everything is done under one roof. But today, communications technology has dramatically reduced the costs of having certain jobs done out-of-house. Will firms live as long as they once did?

It seems not: Richard Foster, a lecturer at the Yale School of Management, has found that the average lifespan of an S&P company dropped from 67 years in the 1920s to 15 years today. Foster also found that on average an S&P company is now being replaced every two weeks, and estimates that 75 percent of the S&P 500 firms will be replaced by new firms by 2027.

With so many firms dying off at a faster rate, what is becoming of them? Are they just going belly up? A new report from the Santa Fe Institute says quite the contrary: American companies die to create new companies or become a part of another company. Looking at a database of 25,000 companies from 1950 to 2009, the group of researchers employed mathematical models from theoretical ecology to look at the the lifespans of American companies. They found that publicly traded companies die off at the same rate, regardless of the firm's age or what sector it's in. In their dataset, they found that most firms live about 10 years and the most common reason a company disappears is due to a merger or acquisition.

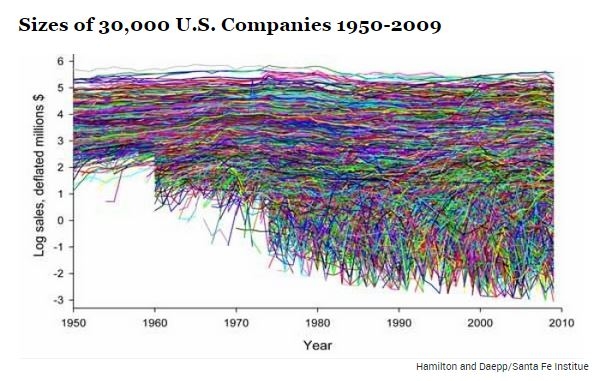

This graph shows the sizes of 30,000 publicly-traded companies, with sales leveling off as companies reach maturity.

The researchers at Santa Fe Institute note that their findings are different from what you would see in Europe and Japan. The latter is home to more than 50,000 companies that are over 100 years old (including this 1,300-year-old inn), though these ancient family-run businesses are also starting to face mortality in light of Japan's updated bankruptcy legislation. Foster, on the other hand, has called for American firms to embrace "creative destruction" rather than fight it.

http://www.theatlantic.com/business/archive/2015/04/where-do-firms-go-when-they-die/390249/?google_editors_picks=true

I copied the article below. A simple point, many kids want a career in something that interests them whether it be science, engineering, marketing, acting, music or education (and many, many more options). Other posters have mentioned that many are burdened with student loan debt and that opportunities are not all that plentiful in their chosen areas -- eg, while history is fascinating and I read a lot of it, it is very hard to get a job that uses history as history, eg, a history teacher. But one can use the study of history to be able to think long term about something else in a field that may also be of interest to a student of today. Corporations might find that having someone who is not enraptured by a piece of tech actually very useful as, to be blunt, much of what we see as tech today is fashion driven, not necessarily driven by utility.

But The Atlantic article (link above, article below) suggests that for the foreseeable future technology is shortening the lifetime of firms. I think the very nature of the corporation is under attack as technology allows for so many functions to be done by others -- look at Apple, a giant of a corporation loaded with wealth, so much wealth they do not know what to do with it. Apple is a true marketing machine. Its manufacturing is done by others; shipping by someone else. They design and package better than anyone. But once you leave the world of Apple and Google and look at smaller firms that are not the top of the heap in banking or tech, we see a different story -- careers will be hard to come by as firms come and go.

Your kids and mine may end up working for a pile of companies that go in and out of existence much like the virtual particles in the vacuum (that's a physics thing!). That transition has already occurred and many of us have already been through that. I think it will get only more difficult to stay with a company for many years. What goes along with that is a weakening of the social fabric supporting us all -- social security and medicare, pensions, even savings as banks have the penchant for risking a lot of money and periodically losing it all.

So I ask once again, what do we teach our kids now? The world of 2031 looks pretty scary to me and are we really going to give our kids the foundation for survival -- meaning establishing a career, being able to have a family and a home, live a good life -- when so much is in flux?

Here's the article (space may require it to be in two parts, this post and the next):

Where Do Firms Go When They Die?

Companies can't live forever, and the average lifespan of a publicly traded company is dropping. The good news is they become other companies.

BOURREE LAMAPR 12 2015, 8:00 AM ET

In the classic economic paper The Nature of the Firm, Nobel economist Ronald Coase wrote about why firms exist. Coase's argument was that firms lower the costs of producing goods and services, because it's easier to coordinate people and projects when everything is done under one roof. But today, communications technology has dramatically reduced the costs of having certain jobs done out-of-house. Will firms live as long as they once did?

It seems not: Richard Foster, a lecturer at the Yale School of Management, has found that the average lifespan of an S&P company dropped from 67 years in the 1920s to 15 years today. Foster also found that on average an S&P company is now being replaced every two weeks, and estimates that 75 percent of the S&P 500 firms will be replaced by new firms by 2027.

With so many firms dying off at a faster rate, what is becoming of them? Are they just going belly up? A new report from the Santa Fe Institute says quite the contrary: American companies die to create new companies or become a part of another company. Looking at a database of 25,000 companies from 1950 to 2009, the group of researchers employed mathematical models from theoretical ecology to look at the the lifespans of American companies. They found that publicly traded companies die off at the same rate, regardless of the firm's age or what sector it's in. In their dataset, they found that most firms live about 10 years and the most common reason a company disappears is due to a merger or acquisition.

This graph shows the sizes of 30,000 publicly-traded companies, with sales leveling off as companies reach maturity.

The researchers at Santa Fe Institute note that their findings are different from what you would see in Europe and Japan. The latter is home to more than 50,000 companies that are over 100 years old (including this 1,300-year-old inn), though these ancient family-run businesses are also starting to face mortality in light of Japan's updated bankruptcy legislation. Foster, on the other hand, has called for American firms to embrace "creative destruction" rather than fight it.

davidfrazer said:

nakaille said:

Yes, it is, mjh.

ETA: The curriculum needs to be beefed up, imo. My kid thought it was a boring joke for the most part.

My kids had same reaction but beefing up the curriculum is going to be pretty tough. It's hare to get adolescents excited about balancing a check book.

I hope to heavens it is including retirement planning...we run the middle school simulation with the fake baby, and I hope we can run the career simulation that allows students to see the difference between life choices that lead to comfort and life choices that lead to deprivation.

The personal finance class is a state mandated class and I am happy that it is now a part of the curriculum.

As for the curriculums in our schools, they need to be looked at and updated to include, project based learned, STEM, and the makers movement. We also must incorporate much more technology skills.

The Next Gen science standards and the new NJ technology standards that have come out do a good job addressing some of these issues. I think they are going to force the district to rethink how they deliver instruction. The problem is that our district tends to not update the curriculum even when they need to. The middle school English curriculum still does not incorporate all the CCSS.

Our district needs to also make sure we have a team of teachers and admins working together to write the curriculum. Recently it has only been admins or one or two teachers. A well written curriculum would include a wide variety of experts.

Where I work now the curriculum is written by teachers and admins and goes through a huge process of checks from a curriculum review committee of teachers from multiple subject areas before it is given to the board for approval. We have nothing like that in place here.

We also need to make sure that teachers get the training and support necessary to implement any new curriculum. Without that it is bound to fail.

As for the curriculums in our schools, they need to be looked at and updated to include, project based learned, STEM, and the makers movement. We also must incorporate much more technology skills.

The Next Gen science standards and the new NJ technology standards that have come out do a good job addressing some of these issues. I think they are going to force the district to rethink how they deliver instruction. The problem is that our district tends to not update the curriculum even when they need to. The middle school English curriculum still does not incorporate all the CCSS.

Our district needs to also make sure we have a team of teachers and admins working together to write the curriculum. Recently it has only been admins or one or two teachers. A well written curriculum would include a wide variety of experts.

Where I work now the curriculum is written by teachers and admins and goes through a huge process of checks from a curriculum review committee of teachers from multiple subject areas before it is given to the board for approval. We have nothing like that in place here.

We also need to make sure that teachers get the training and support necessary to implement any new curriculum. Without that it is bound to fail.

Using committees for curriculum change was always part of that process in district up to about 12-15 years ago.

Administration usurped the curriculum changes and we see the results .

Administration usurped the curriculum changes and we see the results .

Agreed icdart - we must change the culture in this district in order for change to occur.

In order to add a comment – you must Join this community – Click here to do so.

Featured Events

-

Stephen Whitty Presents - Hometown Movie Stars: The Celebrated Actors Of CHS

May 6, 2024 at 7:00pm

ETA: The curriculum needs to be beefed up, imo. My kid thought it was a boring joke for the most part.