A wall-streeter says tax the wealthy archived

pennboy2 said:

How does this person think our society functions? How does this person think wealth is created? By me working really hard to create value for his family,

Thank you, pennboy. My family and I are deeply appreciative of your heroic efforts.

There, happy now?

I'm happy in witnessing your complete ignorance of how society functions, and your own self regard. Honestly, it does make me smile.

How about this? How about I work really hard for complete strangers, and count on complete strangers to provide food and shelter to me and my family?

Let us completely reorganize our society based on yours and your friends utter selflessness.

I love this!

Let us completely reorganize our society based on yours and your friends utter selflessness.

I love this!

A hundred and fifty grand.

People earning this princely sum are expected to shoulder more than 60% of the Federal tax burden of this society, and more, if we follow our socialist friends.

You know what kind of person could consider this reasonable? Someone who doesn't produce much wealth in our society. Someone who doesn't make much money. Someone who pays no Federal income tax.

51% of people paying little in Federal income tax saying that people making 150 grand should pay even more. Sick.

People earning this princely sum are expected to shoulder more than 60% of the Federal tax burden of this society, and more, if we follow our socialist friends.

You know what kind of person could consider this reasonable? Someone who doesn't produce much wealth in our society. Someone who doesn't make much money. Someone who pays no Federal income tax.

51% of people paying little in Federal income tax saying that people making 150 grand should pay even more. Sick.

In most parts of the country, 150 grand is a princely sum. And, for better or worse, we who make that much or more here have chosen to live here.

pennboy2 said:

A hundred and fifty grand.

People earning this princely sum are expected to shoulder more than 60% of the Federal tax burden of this society, and more, if we follow our socialist friends.

You know what kind of person could consider this reasonable? Someone who doesn't produce much wealth in our society. Someone who doesn't make much money. Someone who pays no Federal income tax.

51% of people paying little in Federal income tax saying that people making 150 grand should pay even more. Sick.

That's a majority. I thought you liked majorities.

Our socialist friends seem to think that the top 10% in income paying 70% of the income tax is not enough.

I wonder how much is enough for them? How much exactly should the incredible wealthy person making 150 grand pay?

I look forward to a concrete answer.

It is an ignorance of numbers, of history and of economics.

I wonder how much is enough for them? How much exactly should the incredible wealthy person making 150 grand pay?

I look forward to a concrete answer.

It is an ignorance of numbers, of history and of economics.

The ignorant selfish liberal view of the hard working family man making 150 grand in America today:

The liberal view of a wealth generator in our society if he were a mallard:

pennboy2 said:

The ignorant selfish liberal view of the hard working family man making 150 grand in America today:

Relax. Your friends at the top think you're making a pittance, and that your house is a hovel.

gibberellin said:

pennboy2 said:

The ignorant selfish liberal view of the hard working family man making 150 grand in America today:

Relax. Your friends at the top think you're making a pittance, and that your house is a hovel.

What are you doing constantly posting on MOL? I'm relying on you to care for me and my loved ones.

After all, you don't care about your money. You want everyone to love and care for everyone else. You should get back to whatever work you do such that we can all profit from it. You surely have a great incentive to work for strangers, given how wonderfully selfless you are, compared to evil conservatives.

Thank you for your work, please send me and my family a check for $5,000. You don't care about your money, of course. You are better than that.

Hon,

I think you post at least six times for every one of my posts. So, looks like my work ethic is just fine.

I think you post at least six times for every one of my posts. So, looks like my work ethic is just fine.

pennboy2 said:

Thank you for your work, please send me and my family a check for $5,000. You don't care about your money, of course. You are better than that.

psssssst

5k is just small change in the circles you aspire to--remember Romney and his 10k bet?

you're showing your (middle class) hand here

ktc said:

Republicans like high unemployment. Keeps their labor costs down.

There you go again with the lies and divisiveness. SO productive and adds SO many solutions.

It's par for the course with you though...

Keep hating

pennboy, I think the wikipedia page on human rights explains the concept adequately. You either have a right, or you don't. These rights are viewed by some as coming from God. Others just feel it's an ethical requirement that people have them. On ethical issues, there can be no laws except when there is near unanimity about them.

I'm not describing how things ought to be. I am describing the world as it is now. Blowhards don't notice this because they're too busy insulting people to see the obvious. But I can't help with that.

Put another way, each person gets to do whatever the phuque he wants to do, provided (1) he fulfills his duties to others (including society) and (2) he does no harm to others. This is called liberty.

You speak of individual liberties, such as keeping the fruits of your labor, but you want to deny rights to others. Bull.

But this is a tangent. This thread is about taxation. It's not about human rights. Let's talk about taxation.

Either you agree that individuals are taxable for the benefit of society or you don't agree. Once you agree, all that's left to do is to negotiate how much taxation is reasonable.

You repeatedly ask what level of taxation is excessive. As I said recently, I don't have an answer to this, and neither do you. You have yet to propose one, and if you proposed one, it would be arbitrary and subject to all kinds of interpretation and context. It's not about the numbers. The question is wrong.

You use the word socialism as if it's a bad thing. Society has always had some social institutions. A church is an example: people pool their money and decide collectively what to do with it. A barn raising, from the days of the frontier, was an example of neighbors helping out as a form of paying forward or paying back for similar barn raisings.

A government needs revenue. We have to decide what the government should do (which requires spending) and how to raise the money (which requires taxing). If you want a government, you'll want taxation. (Really, why am I explaining this to you?)

If you really are opposed to taxation and think it's as evil as Marxist Soviet socialism, I'd like to know what you would replace American government with.

A tax system addresses who should pay which portion. There is no way to tax blindly without asking how to divide the obligations. So the result is that you pay $X and I pay $Y. How can it be any other way?

I realize that it's hard for boors to consider that others might have a point. It's also hard to admit when they've made a mistake. Boors are also known for not apologizing. That's why this discussion doesn't progress.

I'm not describing how things ought to be. I am describing the world as it is now. Blowhards don't notice this because they're too busy insulting people to see the obvious. But I can't help with that.

Put another way, each person gets to do whatever the phuque he wants to do, provided (1) he fulfills his duties to others (including society) and (2) he does no harm to others. This is called liberty.

You speak of individual liberties, such as keeping the fruits of your labor, but you want to deny rights to others. Bull.

But this is a tangent. This thread is about taxation. It's not about human rights. Let's talk about taxation.

Either you agree that individuals are taxable for the benefit of society or you don't agree. Once you agree, all that's left to do is to negotiate how much taxation is reasonable.

I look forward to a concrete answer.

You repeatedly ask what level of taxation is excessive. As I said recently, I don't have an answer to this, and neither do you. You have yet to propose one, and if you proposed one, it would be arbitrary and subject to all kinds of interpretation and context. It's not about the numbers. The question is wrong.

You use the word socialism as if it's a bad thing. Society has always had some social institutions. A church is an example: people pool their money and decide collectively what to do with it. A barn raising, from the days of the frontier, was an example of neighbors helping out as a form of paying forward or paying back for similar barn raisings.

A government needs revenue. We have to decide what the government should do (which requires spending) and how to raise the money (which requires taxing). If you want a government, you'll want taxation. (Really, why am I explaining this to you?)

If you really are opposed to taxation and think it's as evil as Marxist Soviet socialism, I'd like to know what you would replace American government with.

A tax system addresses who should pay which portion. There is no way to tax blindly without asking how to divide the obligations. So the result is that you pay $X and I pay $Y. How can it be any other way?

I realize that it's hard for boors to consider that others might have a point. It's also hard to admit when they've made a mistake. Boors are also known for not apologizing. That's why this discussion doesn't progress.

Tom_Reingold said:

(Really, why am I explaining this to you?)

Because he's posting not as an adult, but as a petulant pre-teen.

And petulant pre-teens know nothing about mathematics and the way the world works.

I might enjoy playing this pennboy game. Am I getting the hang of it?

from 1945 until the 1980s, the U.S. had marginal tax rates that much, much higher than today. would it be "historically ignorant" for someone to pretend that period of our past never happened?

You know, I'm coming to the conclusion that the poor guy really feels oppressed. He imagines we're all a bunch of evil people who are dying to confiscate his hard earned money and give it to, gasp, welfare mothers. Just for the heck of it.

IOW, his side of the conversation is driven purely by emotion rather than reason.

But I suppose that's obvious to anyone who reads his posts.

IOW, his side of the conversation is driven purely by emotion rather than reason.

But I suppose that's obvious to anyone who reads his posts.

ml1 said:

from 1945 until the 1980s, the U.S. had marginal tax rates that much, much higher than today. would it be "historically ignorant" for someone to pretend that period of our past never happened?

Wasn't that a period of great economic growth and a rising standard of living?

When is too much too much? is a valid question. Especially when you're the one paying the freight. Just sayin.

Oh, you're the one paying for everyone else, jld? This is very confusing, I thought it was pennboy. Or cjc.

So hard to keep track.

So hard to keep track.

ml1 said:

from 1945 until the 1980s, the U.S. had marginal tax rates that much, much higher than today. would it be "historically ignorant" for someone to pretend that period of our past never happened?

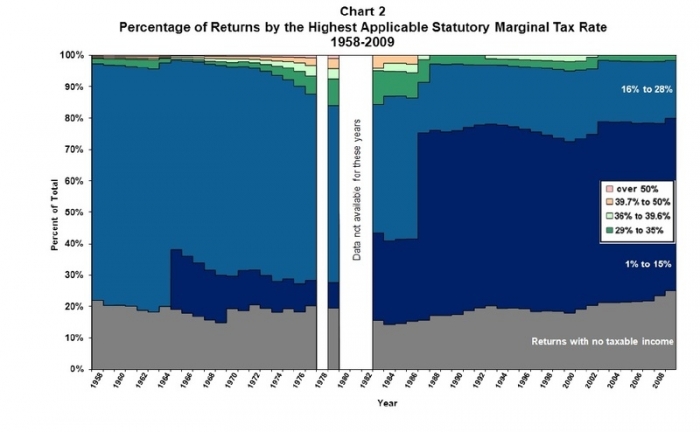

Of course, one shouldn't pretend something in the past hasn't happened. However, we should understand the effects of this. Very, very few paid these tax rates. The fact is that "the rich" pay a much higher percent of taxes today. Once you raise rates to extremely confiscatory levels, people spend a lot of energy towards tax avoidance. People generally don't want to work for 10 cents on the dollar.

From the Tax Policy Center

The impact of more brackets and higher rates on taxpayers and revenues depends on how much taxable income falls in each of the tax rate brackets. In 1963, for example, only 501 returns (of 64 million filed) reported taxable income in the 91 percent bracket, and that taxable income generated only $62 million in income tax revenue, or just 0.1 percent of the $42 billion total reported. Of course, many more returns reported taxable income in the other high brackets in 1963, and reported taxable income in many of these brackets raised significant income tax revenue.

Dec 1, 2012 at 12:08am Edited

Tom_Reingold said:

pennboy, I think the wikipedia page on human rights explains the concept adequately. You either have a right, or you don't. These rights are viewed by some as coming from God. Others just feel it's an ethical requirement that people have them. On ethical issues, there can be no laws except when there is near unanimity about them.

I'm not describing how things ought to be. I am describing the world as it is now. Blowhards don't notice this because they're too busy insulting people to see the obvious. But I can't help with that.

Put another way, each person gets to do whatever the phuque he wants to do, provided (1) he fulfills his duties to others (including society) and (2) he does no harm to others. This is called liberty.

You speak of individual liberties, such as keeping the fruits of your labor, but you want to deny rights to others. Bull.

But this is a tangent. This thread is about taxation. It's not about human rights. Let's talk about taxation.

Either you agree that individuals are taxable for the benefit of society or you don't agree. Once you agree, all that's left to do is to negotiate how much taxation is reasonable.

This is a dazed and confused post. Not taxing one person does not "deny rights to others" for a start. Hello?

You are missing one really important truth, and you get lost in your obsession with "well, if society agrees this tax and this level of government, then that is legitimate." That is not true.

The truth that you are missing is that economic rights are indeed God given. I have the right to my labor, and you taking it from me has to be done in only very limited circumstances to make it legitimate.

Now, your childlike belief in "if we vote for it, it is good" collapses on simple inspection. Let's say 51% of the people vote to have 25% of the population pay 90% of the taxes. Then let's say 51% says 10% should pay 90% of the taxes.

At the next election, 51% says 1% should pay all of the taxes, and that government should get even larger. Is this moral? Is this legitimate? Simply because 51% of the population says that 1% should pay everything, and that 99% should pay nothing, has no moral claim to legitimacy.

The left's claim that human rights should not be put to a vote should naturally extend to one of my most important and intimate rights: what I earn from my labor. How can you not see that?

The minimal state is the only morally legitimate organization. We are so far from it, and your socialist views are so profoundly immoral, that you will likely never be able to understand this.

All of this doesn't matter anyway, because of Hauser's Law.

One thing the loony left will never understand, among the many things they are clueless about, is that it is a fact that if you tax something you will get less of it.

Tax millionaires and you will get fewer millionaires. Tax labor and you will get less labor.

Their obsession with taking money from the successful and hard working serves two destructive purposes: giving disincentives to wealth creators to create wealth, and giving disincentives to recipients of this largesse to work and take personal responsibility for their own lives. It is disgusting.

One thing the loony left will never understand, among the many things they are clueless about, is that it is a fact that if you tax something you will get less of it.

Tax millionaires and you will get fewer millionaires. Tax labor and you will get less labor.

Their obsession with taking money from the successful and hard working serves two destructive purposes: giving disincentives to wealth creators to create wealth, and giving disincentives to recipients of this largesse to work and take personal responsibility for their own lives. It is disgusting.

Tom_Reingold said:

You use the word socialism as if it's a bad thing.

The American left does not understand economics or wealth creation, and it has not learned from history.

Anyone looking at the last 300 years of economic history can only come to the conclusion that capitalism and the market mechanism have been the greatest sources of health and human happiness ever devised by man. Anyone, that is, except the American liberal.

pennboy2 said:

Tom_Reingold said:

You use the word socialism as if it's a bad thing.

The American left does not understand economics or wealth creation, and it has not learned from history.

Anyone looking at the last 300 years of economic history can only come to the conclusion that capitalism and the market mechanism have been the greatest sources of health and human happiness ever devised by man. Anyone, that is, except the American liberal.

You appear to be mistaking capitalism and the market mechanism with beer, which, as everyone knows, is what the working man utilizes in order to escape from the drudgery of capitalism and the market mechanism. That and meth.

You are living in a strange fantasy land, though, PB2, and I'm glad it's just a fantasy land. I honestly don't know what life would be like in your America, where corporations are allowed to run roughshod across the earth, exploiting whatever and whoever they want with impunity while the limited government, interested only in bombs and sexual organs, stands powerless to protect us.

You can not reply as this discussion is Closed!

Rentals

Employment Wanted

Latest Jobs

Employment Wanted

Help Wanted

-

May 3, 2024 at 2:32pm

-

Cat Lovers - become part of our lovely Silver Hound Cat Sitter team

May 3, 2024 at 2:12pm

-

PT Driving mother’s Helper needed

May 1, 2024 at 10:31am

-

May 1, 2024 at 9:10am

-

May 1, 2024 at 9:10am

-

Part-time Nanny in Scotch Plains

May 1, 2024 at 9:10am

-

May 1, 2024 at 9:10am

-

May 1, 2024 at 9:10am

-

Full-time Nanny in Scotch Plains

May 1, 2024 at 9:10am

-

Nanny Wanted Live in or Live out $1400-$1600

May 1, 2024 at 4:49am

From what's left, they also pay real estate, consumption and other taxes.

And then, if they are able to save more than $3.5 million in their lifetimes, the government will take upwards of 40% of what they have saved more than that number.

Why? To finance government in this country that spends just shy of 50% of the gross national product.

People who support this are basically socialists. I admire the ones who admit it, as misguided and historically ignorant they are. The ones who don't admit it are delusional.