Trump's Tax Reform "plan" and the media's economic illiteracy.

The estate tax should be abolished, plain and simple. It is the worst example of double taxation that exists. And death tax is not an unfair term for it.

If this plan does get enacted (and the dull reaction of the stock markets after it was presented leads me to believe that many think that is a big "if"), the hardest part will be sorting out what is compensation at the higher brackets vs. what is pass through business income at 15%. Doesn't seem like it would be too hard to structure what would otherwise be wages as business income.

au contraire, the estate tax is the best mechanism for the preventing of the building of family dynasties, which everyone agrees is a good thing, except for the dynasties.

What, may I ask, is good about tax-less inheritances? Who gains? Certainly not society.

And of course, nothing is double taxed, (or, as some people believe, and rightly so, pretty much everything is double taxed, so it's just another right-wing doofus argument) and it's not death that 's getting taxed anyway. The dead guy doesn't pay the tax, does he?

Someday, the right wing will come up with at least one talking point that actually makes sense.

We will not hold our breath.

ice said:

The estate tax should be abolished, plain and simple. It is the worst example of double taxation that exists. And death tax is not an unfair term for it.

If this plan does get enacted (and the dull reaction of the stock markets after it was presented leads me to believe that many think that is a big "if"), the hardest part will be sorting out what is compensation at the higher brackets vs. what is pass through business income at 15%. Doesn't seem like it would be too hard to structure what would otherwise be wages as business income.

Certain members of the media like the tax cut, because they're wealthy enough to like tax cuts.

The rationale for reducing business taxes is to make US businesses more competitive internationally. It makes sense. They should reduce loopholes as well. That would be real tax reform, which they won't do.

Why do they need to be "more competitive". They've had YEARS of record profits. What the hell more do they want? What would they do with more money, other than increase management bonuses and shareholder dividends?

jimmurphy said:

The rationale for reducing business taxes is to make US businesses more competitive internationally. It makes sense. They should reduce loopholes as well. That would be real tax reform, which they won't do.

The reason for all the BS corporate inversions and some of the reason for manufacturing overseas is our high corporate tax rates. The reason why American corporations like Apple don't want to bring profits home is because of our relatively high corporate tax rates.

We should reduce corporate rates and increase capital gains and personal income taxes at the higher brackets.

Should...

jimmurphy said:

The reason for all the BS corporate inversions and some of the reason for manufacturing overseas is our high corporate tax rates. The reason why American corporations like Apple don't want to bring profits home is because of our relatively high corporate tax rates.

We should reduce corporate rates and increase capital gains and personal income taxes at the higher brackets.

Should...

While I get the argument, it can also be argued that if Apple isn't hurting by leaving taxable profits abroad when taxes are 35% (or similar number) why should they want to bring them over when it's 5%? It's still going to get taxed, and leaving it offshore has no penalty.

A "solution" cut and pasted below. (I will admit that I don't know how this would not result in a race to the bottom by nations.) Seems like firms would have to decide whether to continue to be US corporations. If the rates were competitive, seems to me they'd stay.

I welcome divergent opinions.

How to solve the problem

The simplest solution is to end “deferral,” as proposed by Sen. Bernie Sanders and Rep. Jan Schakowsky. Corporations would pay taxes on offshore income the year it is earned, rather than indefinitely avoid paying U.S. income taxes. This would also remove incentives to shift U.S. profits to tax havens, and it would raise $600 billion over 10 years.

Short of ending deferral, Congress should close the most egregious loopholes, such as “check the box,” “transfer pricing,” the “active financing exception” and corporate “inversions.” It should also end the loophole that lets firms deduct the cost of expenses from moving jobs and operations offshore if the profits earned from those activities remain offshore and untaxed by the U.S. — saving $60 billion over 10 years.

Sen. Carl Levin (D-MI) has introduced legislation, the Stop Tax Haven Abuse Act (S. 1533), that will close some of these loopholes. It will raise $220 billion over 10 years.

jimmurphy said:

A "solution" cut and pasted below. (I will admit that I don't know how this would not result in a race to the bottom by nations.) Seems like firms would have to decide whether to continue to be US corporations. If the rates were competitive, seems to me they'd stay.

I welcome divergent opinions.

How to solve the problem

The simplest solution is to end “deferral,” as proposed by Sen. Bernie Sanders and Rep. Jan Schakowsky. Corporations would pay taxes on offshore income the year it is earned, rather than indefinitely avoid paying U.S. income taxes. This would also remove incentives to shift U.S. profits to tax havens, and it would raise $600 billion over 10 years.

Short of ending deferral, Congress should close the most egregious loopholes, such as “check the box,” “transfer pricing,” the “active financing exception” and corporate “inversions.” It should also end the loophole that lets firms deduct the cost of expenses from moving jobs and operations offshore if the profits earned from those activities remain offshore and untaxed by the U.S. — saving $60 billion over 10 years.

Sen. Carl Levin (D-MI) has introduced legislation, the Stop Tax Haven Abuse Act (S. 1533), that will close some of these loopholes. It will raise $220 billion over 10 years.

This makes more sense. Corporations are people, so tax them like we do US citizens. Anywhere in the world they make money, tax them.

Our corporate tax rate is not as it seems because of the loopholes that allow corporations to stash money or avoid paying. Some corporations don't pay anything.

nan said:

Our corporate tax rate is not as it seems because of the loopholes that allow corporations to stash money or avoid paying. Some corporations don't pay anything.

Yes:

jimmurphy said:

The rationale for reducing business taxes is to make US businesses more competitive internationally. It makes sense. They should reduce loopholes as well. That would be real tax reform, which they won't do.

nan said:

Our corporate tax rate is not as it seems because of the loopholes that allow corporations to stash money or avoid paying. Some corporations don't pay anything.

Doesn't apply to GE, Pfizer, Apple, etc. Only applies to the family running 3 franchise donut shops in Queens.

This "plan" (actually something I could have written myself in an hour, just by knowing the right wing talking points of the past 30 years) has no chance of passing. It can't pass through reconciliation because there's no chance of coming up with sufficient budget cuts to make it revenue neutral. I suspect it's completely political, and when it gets filibustered by Democrats, Trump and McConnell can run around the country saying -- "the Democrats denied you a tax cut!"

nan said:

Our corporate tax rate is not as it seems because of the loopholes that allow corporations to stash money or avoid paying. Some corporations don't pay anything.

If they got rid of the loopholes, I might support the cut.

ml1 said:

I suspect it's completely political, and when it gets filibustered by Democrats, Trump and McConnell can run around the country saying -- "the Democrats denied you a tax cut!"

And for many that will be true. Many lower middle class and working class income earners will have been denied if the Democrats kill this.

That's due to the doubling of the standard deduction. I read somewhere (don't ask me for the link because I forget where) that doubling this deduction will lead to about 35 million filers switching to the standard deduction. That's a lot of individuals and families who will gain.

Who will be hurt? Upper middle income and well-to-do taxpayers living in blue states. The ones who who have over 24,000 (and maybe more depending on # of dependents) in itemized deductions. Their hurt will be in the loss of the state and local tax itemized deductions. But generally, the high tax and income blue states did not vote for Trump.

The ones who voted for him, the purple and red states, that have less than 24,000 in itemized deductions are the ones who will gain and will continue to vote Republican.

Also, I didn't count exemptions. So, if you have a family of four, its not just a 24,000 standard deduction. Its 24,000 plus a 4,000 exemption for each dependent.

If it was just a tax cut for people below the median, and it was offset by some increases elsewhere, I'd be in favor. But as usual for someone like Trump, in absolute dollars most of this cut would go to very wealthy people.

They needed to make it at least revenue-neutral if not revenue-increased and that could have been done by adding another higher bracket or two, but the billionaires can't take that.

And of course the states that will be hurt most by the elimination of the state/local tax deduction are blue states.

ml1 said:

If it was just a tax cut for people below the median, and it was offset by some increases elsewhere, I'd be in favor. But as usual for someone like Trump, in absolute dollars most of this cut would go to very wealthy people.

If the very wealthy, lets say .1% of the population, get a nice tax cut and also 20% of the working class get one, I would be OK with that. Even though I wouldn't like it.

Sadly, there is usually an unpleasant trade off. Obamacare is an example. Many people are helped whereas much of the cost is passed to the young and healthy who get economically screwed.

To be against it because a few very wealthy benefit is like saying I don't want my measly raise because raise package will also give the big bosses big raises.

My real issue with this plan is that it is unrealistic. These kinds of tax cuts will balloon the deficit. There's really no such thing as a free lunch.

Trump and his family, and their zillionaire Mar-a-Lago friends, will pay much less. But the NYT says among the losers would be --

Upper-middle-income people in blue states. The plan would eliminate the federal tax deduction for state and local income tax. If you are in a place where such taxes are high, like New York or California , you would lose a valuable deduction.

The property tax deduction goes too, I believe. So the biggest losers are US.

I've always claimed I was prepared to pay higher taxes if the government would do something I supported. But defense, a border wall and stepped-up ICE enforcement aren't on my list.

You guys may not like having a Republican Congressman but at times like this it is very useful. The Republican Congressmen from NJ, NY and CA are very important now to seeing that the income and property tax deductions remain.

Our corporate tax is, on paper, very high, but effectively not (Handy Explainer Slide). I'd certainly be in favor of reversing that -- slashing the actual rate but also removing many of the deductions, credits, and other loopholes to close that gap between the statutory and effective rates.

But, if I was feeling really ambitious and had a magic wand, I'd actually be in favor of eliminating all businesses taxes and instead adding a lot more brackets to the income tax. I'd rather not have the government trying to figure out what the "appropriate" amount of corporate profits are, or whether the CEO is being paid too much. I'd much rather make sure that executives who are super highly compensated pay much higher taxes than they do now, and then let businesses negotiate with their executives the appropriate level of compensation, given that super high compensation would mean super high taxes on those receiving it.

And if I were _really_ ambitious and could just snap my fingers without needing a magic wand at all, I'd make all taxes effectively one giant progressively-leveled, sales, tax, levied only when money is transferred between individuals. When a company "purchases" labor, levy the tax there (effectively an income tax). Make the progressive rate bands steeper and more numerous than they are now -- last $1,000 of a $1,000,000 purchase should be taxed much, much higher than the last $1,000 of a $500,000 purchase, and below some threshholds there should be no tax at all.

Selling property? Collect the tax there (and maybe have the tax paid out to the locality over several years to even out their budgeting so you don't get huge swings between years of high property sales and low ones).

And make all of this as automatic as possible. Nice and simple, can fit on a post card, and can probably shrink the size of the IRS pretty dramatically as a result.

This would, of course, only ever happen with actual magic, as it's the idea of taxes (and the commensurate idea that we actually owe something to each other collectively), not the collection, nature, or complexity of the tax system, that most of the political right oppose.

Gilgul said:

You guys may not like having a Republican Congressman but at times like this it is very useful. The Republican Congressmen from NJ, NY and CA are very important now to seeing that the income and property tax deductions remain.

Good point.

marylago said:

Gilgul said:Good point.

You guys may not like having a Republican Congressman but at times like this it is very useful. The Republican Congressmen from NJ, NY and CA are very important now to seeing that the income and property tax deductions remain.

Except if all the Republicans in the House from NJ, NY and CA were Democrats instead, the G.O.P. would be the minority party, which you guys would probably like even more.

Don't think upper middle class families in blue states will be significantly negatively impacted they as never had the deductions for state and local taxes in the first place, as they are generally subject to AMT - where they lost those deductions and all personal exemptions.

The only significant deductions allowed under the AMT are mortgage interest and charitable contributions - both of which will continue to be deducted under the new plan.

Since the AMT rate varies between 26 and 28 percent, and if upper middle class families end up falling into the new 25% tax bracket - there should be some tax relief.

Sometimes intellectuals who serve the wealthy class are honest about their intentions. See the bold-face below:

https://www.wsj.com/articles/balancing-lost-tax-revenue-the-reagan-way-1493245888?mod=e2tw

Balancing Lost Tax Revenue the Reagan Way

Gradually increasing the Social Security eligibility age can offset revenue loss from Trump’s tax cuts.

By Martin Feldstein

April 26, 2017 6:31 p.m. ET

Treasury Secretary Steven Mnuchin calls the Trump administration’s tax proposal “the largest tax reform in the history of our country.” The plan would slash corporate tax rates from 35% to 15% and roll back increases in individual rates that occurred under Presidents Clinton and Obama.

The announcement represents a first step toward a White House budget proposal that combines the president’s fiscal plans with reforms to defense spending and domestic policies including ObamaCare. If such a budget is passed, it would stimulate business investment, boost productivity and improve real wages. It would also reverse the decline in military preparedness by raising defense outlays from a projected 2.6% of gross domestic product back to at least 4%.

The challenge will be to do all of this without increasing long-run fiscal problems. The federal government’s debt has already more than doubled in the past decade, reaching upward of 75% of GDP. The Congressional Budget Office projects that the debt will grow to more than 100% of GDP in the next 15 years even without a reduction in tax revenue or an increase in defense outlays.

Higher projected budget deficits could raise long-term interest rates, potentially triggering failures in the fragile financial markets and a serious economic downturn. The markets’ current fragility reflects overpriced assets—the S&P price/earnings ratio is now 70% above its historical average—after a decade of excessively low long-term interest rates engineered by the Federal Reserve.

Republicans expect to pass their tax plan through the Senate’s reconciliation process, but there are strings attached. If the bill causes deficits beyond the decadelong forecast horizon, a sunset rule kicks in and ends the tax cuts in the 10th year. To prevent this, congressional Republicans propose to balance revenue losses from the personal tax changes by eliminating all tax deductions other than those for charitable contributions and mortgage interest. That means the new revenue would come from the one-third of taxpayers who itemize deductions, households that tend to have higher incomes, supporting Mr. Mnuchin’s promise that the tax plan will not be a gift to the rich.

In addition to cutting corporate rates, President Trump proposes a similar tax cut for partnerships and other unincorporated pass-through businesses. House Republicans have also promised to allow American companies to repatriate after-tax profits earned abroad without penalty.

Preventing the business tax cuts from increasing the budget deficit will not be easy. The corporate tax raises revenue equal to about 2% of GDP. Cutting the rate in half will increase the annual deficit by about 1% of GDP, or nearly $200 billion. Faster economic growth due to increased investment would bring in some extra tax revenue, but probably only about $50 billion per year.

Congressional Republicans propose to offset the other $150 billion by enacting their border-adjustment tax: a 20% levy on imports combined with a 20% subsidy for exports. That should raise about $120 billion or so a year, enough to offset most of the net cost of the corporate tax cut.

Textbook economics implies that a border-adjustment tax, or BAT, would push up the value of the dollar, reducing the price of imports by enough to offset the 20% tax. Americans would therefore see no change in the prices they pay for imported goods. The stronger dollar would also have no effect on the net prices American exporters receive for goods sold overseas. A BAT is thus a pure revenue raiser, with the tax falling on foreign firms that export to the U.S.

But the dollar’s value may not rise as much as theory implies, so American importers and retailers are lobbying against a BAT while major exporters are lobbying for it. Without the BAT, however, the corporate rate cut would add more than $1 trillion to the national debt during the coming decade, weakening the favorable effects of tax reform on capital formation and threatening higher interest rates.

There is no way to shrink the deficit other than by slowing the growth of Medicaid, Medicare and Social Security. Outlays for these programs are now 10.4% of GDP and projected under current law to rise to 12.9% over a decade. ObamaCare’s insurance subsidies and Medicaid expansion now cost the federal government more than $200 billion a year. Reform could contribute significantly to reducing the deficit, although not by enough to balance out everything Mr. Trump is proposing.

The bipartisan Social Security legislation enacted during the Reagan administration provides a useful history lesson for how to offset deficit increases. The 1983 law raised the age of eligibility for full Social Security benefits from 65 to 67 while still allowing actuarially equivalent benefits at earlier ages. The increased age was phased in gradually and began only after a substantial delay.

In the intervening decades life expectancy at 67 has increased by three years. Repeating the Reagan reform by gradually raising the age for full benefits from 67 to 70 for those now under the age of 55 would reduce the annual cost of Social Security by about 15%, or 1% of GDP. Together with reforms of federal health-care spending, that should be enough to close the budget gap created by tax reform and increased defense outlays.

Raising the age for full Social Security benefits would also prevent the crisis in the program that is projected to occur in 2029. That’s when the Social Security trust fund will be exhausted, requiring either an immediate 30% cut in benefits or a sharp tax increase*. A gradual rise in the age for full benefits would be the best way to prevent that crisis as well as to reduce the projected fiscal deficit.

Mr. Feldstein, chairman of the Council of Economic Advisers under President Reagan, is a professor at Harvard and a member of the Journal’s board of contributors.

Appeared in the Apr. 27, 2017, print edition.

* Translation -- raise the maximum income subject to Social Security tax.

newstead77 said:

Don't think upper middle class families in blue states will be significantly negatively impacted they as never had the deductions for state and local taxes in the first place, as they are generally subject to AMT - where they lost those deductions and all personal exemptions.

The only significant deductions allowed under the AMT are mortgage interest and charitable contributions - both of which will continue to be deducted under the new plan.

Since the AMT rate varies between 26 and 28 percent, and if upper middle class families end up falling into the new 25% tax bracket - there should be some tax relief.

A great many middle class families have significant income and property tax deductions but do not get hit with AMT.

So, according to that article, in order to give corporations a tax cut people need to accept less from a program that they have been paying for for their entire working life. And no mention of the size of the defense budget.

yahooyahoo said:

Could Mnuchin suck more public speaking? He is awful.

Mnuchin done what he's paid to do by the new admin. He's no dummy. This plan is fine tuned for Trumps base.

Think about it. The tax plan will help lower-middle and working class with a nice tax cut by doubling the standard deduction. This is the base that voted Trump. A family of four with their dependent exemptions can see a standard deduction of 30,000.

He's also helped his other base, the corporate and the wealthy.

Who's getting the screw? Middle-upper income earners in tax heavy usually blue states. That's OK; they didn't vote for him.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

Featured Events

-

Stephen Whitty Presents - Hometown Movie Stars: The Celebrated Actors Of CHS

May 6, 2024 at 7:00pm

-

'Beethoven's Wrong Note: A Steampunk Opera'

May 12, 2024 at 2:00pm

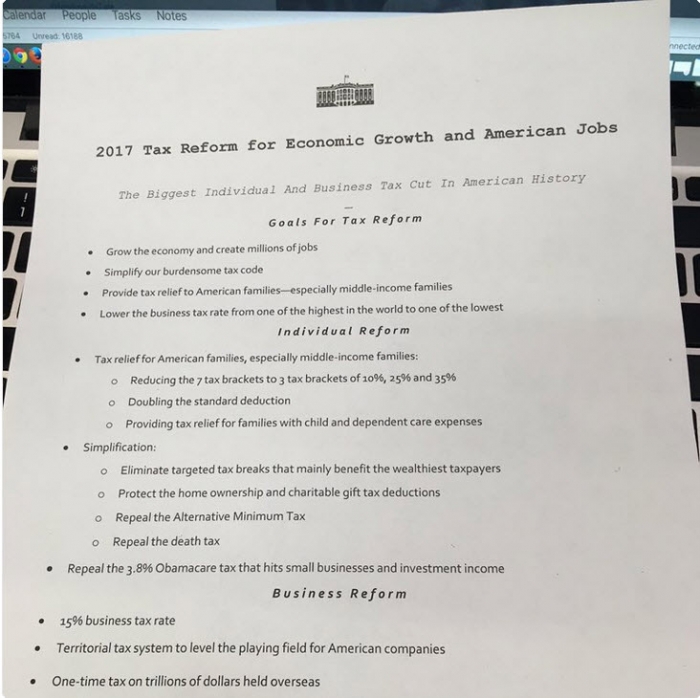

The plan, as presented is ludicrous. It reads more like a middle-schooler's bad homework assignment. The plan is displayed below in its entirety.

But, its announcement allows me to seethe about one of my pet peeves about economic reporting.

Why does every damn talking head merely accept the statement that "reducing corporate taxes will increase jobs" and never challenge it? (At least, when they talk about the preposterous notion that the tax cut will be paid for by increased growth, the TV people push back a little. Not much though.)

There is not a competent business person or economist who would support such a claim. The only job numbers that might increase are in the

financialobscene-wealth handling industry.Only increased demand, putting money in the hands of the buying public, will create jobs. Employers will neither create jobs or give employees more money unless their product's demand demands it.

It's one of the most basic of economic facts, but you would think it doesn't even exist, based on reporting.

(And don't even get me started on the media's acceptance of the phrase 'death tax". The right-wing noise machine wins again.)