The GOP Tax Reform/Cuts Plan

well, they really didn’t get to see the plan even. Not enough time was given to read it . Such a responsible way to vote.

EricBurbank said:

It passed 51-49. When will we get to see the plan?

You've seen it. As have the Democrats. Which is why there are complaints.

We know the new tax table rates, the removal of other local tax deductions, the new pass through rules, the increase in the standard deduction, the removal of the personal exemptions, etc.

Now this Senate version has to be reconciled with the House version.

Here's what's in the Senate tax bill and how it differs from the House's tax bill:

to clarify, taxes for 2917 that we file in Jan-Feb aren’t affected by this, correct? This goes into effect for 2018 taxes?

Just want to be 100% clear before I start pre-paying 2018 taxes in 2017.

conandrob240 said:

to clarify, taxes for 2917 that we file in Jan-Feb aren’t affected by this, correct? This goes into effect for 2018 taxes?

Just want to be 100% clear before I start pre-paying 2018 taxes in 2017.

2017 taxes are not changed. Prepaying 2018 property tax would help. Assuming the limit will be 10,000 in 2018 and onwards, then it seems reasonable a property tax of 15,000 should have 5,000 prepaid.

Is it possible to prepay state income tax as an estimated tax payment done 2017 to be applied to the 2018 tax year?

ps - It seems online in NJ you can't. There's a dropdown box listing what year you want the payment to be applied to. The latest year shown is 2017.

BG9 said:

conandrob240 said:

to clarify, taxes for 2917 that we file in Jan-Feb aren’t affected by this, correct? This goes into effect for 2018 taxes?

Just want to be 100% clear before I start pre-paying 2018 taxes in 2017.

2017 taxes are not changed. Prepaying 2018 property tax would help. Assuming the limit will be 10,000 in 2018 and onwards, then it seems reasonable a property tax of 15,000 should have 5,000 prepaid.

Is it possible to prepay state income tax as an estimated tax payment done 2017 to be applied to the 2018 tax year?

ps - It seems online in NJ you can't. There's a dropdown box listing what year you want the payment to be applied to. The latest year shown is 2017.

You can overpay your estimated taxes for 2017 before the end of the year and then have the amount overpaid for 2017 applied to your 2018 tax instead of getting a refund.

cramer said:

BG9 said:

conandrob240 said:

to clarify, taxes for 2917 that we file in Jan-Feb aren’t affected by this, correct? This goes into effect for 2018 taxes?

Just want to be 100% clear before I start pre-paying 2018 taxes in 2017.

2017 taxes are not changed. Prepaying 2018 property tax would help. Assuming the limit will be 10,000 in 2018 and onwards, then it seems reasonable a property tax of 15,000 should have 5,000 prepaid.

Is it possible to prepay state income tax as an estimated tax payment done 2017 to be applied to the 2018 tax year?

ps - It seems online in NJ you can't. There's a dropdown box listing what year you want the payment to be applied to. The latest year shown is 2017.

You can overpay your estimated taxes for 2017 before the end of the year and then have the amount overpaid for 2017 applied to your 2018 tax instead of getting a refund.

Very nice. Thanks.

I should have thought of that having been in an overpay (refund) situation.

Hatch, on the Children's Health Insurance Program which has been dead for the last few months:

"The reason CHIP is having trouble (passing) is because we don't have money anymore. We add more and more spending and more and more spending, and you can look at the rest of the bill for the more and more spending."

As for the Republican's trillion dollar deficit tax plan:

Not a problem. Hatch voted for it.

I saw this on Facebook just now. I hadn't heard this previously. Is it true or fake news?

Nah - I think there's some interest to see this sort of fake news that may be going around. At least we immediately debunked it. It would be interesting to follow where this originated - was it to hurt the tax plan or get businesses buying things they may not need. hmm

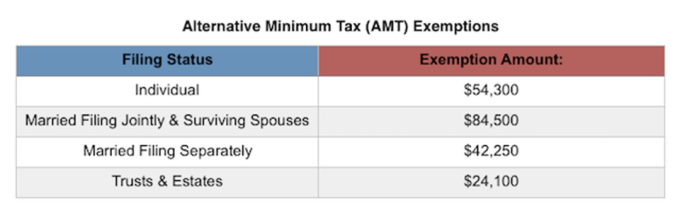

Just a cautionary note about paying 1st and 2nd quarter property tax and overpaying 2017 estimated NJ income tax before year-end: do an AMT calculation to make sure any tax benefit is not eliminated because of AMT.

as a generalization, is it safe to say you won’t owe AMT if your itemized deductions are below this threshold? ( I’ve never owed it before)

I still struggle to understand how the AMT is calculated. I understand the concept and what it means but the math is confusing. I found this link helpful:

http://amtadvisor.com/AMT_Exemption.html

conandrob240 said:

as a generalization, is it safe to say you won’t owe AMT if your itemized deductions are below this threshold? ( I’ve never owed it before)

Getting divorced will get more expensive. The House bill removes the deduction for alimony payments. Ouch.

yahooyahoo said:

Getting divorced will get more expensive. The House bill removes the deduction for alimony payments. Ouch.

Does the receiving spouse still have to pay taxe on the alimony income?

If that's still true then this is double taxation. The paying spouse's alimony money being taxed when he/she received wage/investment used to pay for the alimony and again when the receiving spouse receives the alimony income.

If spouses follow certain rules, the IRS allows the paying spouse to deduct the alimony payments for tax reporting purposes. In turn, the recipient must report the alimony payments as income.

https://www.divorcenet.com/states/nationwide/the_seven_alimony_rules

According to this article, the payer would get taxed while the payments would be tax-free for the receiver. No double taxation, but this increases the amount of tax collected from divorced couples since the payer is typically in a higher tax bracket.

http://www.businessinsider.com/trump-gop-tax-plan-divorce-penalty-2017-11

BG9 said:

yahooyahoo said:

Getting divorced will get more expensive. The House bill removes the deduction for alimony payments. Ouch.

Does the receiving spouse still have to pay taxe on the alimony income?

If that's still true then this is double taxation. The paying spouse's alimony money being taxed when he/she received wage/investment used to pay for the alimony and again when the receiving spouse receives the alimony income.

If spouses follow certain rules, the IRS allows the paying spouse to deduct the alimony payments for tax reporting purposes. In turn, the recipient must report the alimony payments as income.

https://www.divorcenet.com/states/nationwide/the_seven_alimony_rules

yahooyahoo said:

Getting divorced will get more expensive. The House bill removes the deduction for alimony payments. Ouch.

One would think that will also mean lower payments for the receiving spouse since alimony awards often allow for the fact that it is deductible. This could wind up hurting the recipient more than the one losing the deduction. Even though alimony was reported as income for many it was the only source of income and might not have been paying taxes anyway. will not matter to the wealthy who often make a one time payment (see Trump's two divorce settlements).

Basically hurts females that were in long marriages and might have given up a career to have children -- and will now be asked to make do with less. We will need a major increase in affordable housing.

GOP plan: cut taxes on corporations and the wealthy, create a huge deficit, blame the deficit on Medicare, Medicaid and Social Security and proceed to cut those programs.

The attacks on America's social safety net start in 2018:

http://thehill.com/homenews/house/363642-ryan-pledges-entitlement-reform-in-2018

paulsurovell said:

GOP plan: cut taxes on corporations and the wealthy, create a huge deficit, blame the deficit on Medicare, Medicaid and Social Security and proceed to cut those programs.

The attacks on America's social safety net start in 2018:

http://thehill.com/homenews/house/363642-ryan-pledges-entitlement-reform-in-2018

It was all in the plan in the 2016 election.

paulsurovell said:

GOP plan: cut taxes on corporations and the wealthy, create a huge deficit, blame the deficit on Medicare, Medicaid and Social Security and proceed to cut those programs.

The attacks on America's social safety net start in 2018:

http://thehill.com/homenews/house/363642-ryan-pledges-entitlement-reform-in-2018

the worst part of all of this, is that even the GOP voters know this. The bill remains tremendously unpopular everywhere in the country. It's really striking how undemocratic this process has been. The Republicans in Congress are ramming this bill through over the objections of even their own voters.

The country is now in a place where Congress and the White House don't even need to be responsive to their own constituents. Most Republican voters only care about keeping Democrats out of office at all costs. As a result, Congress is free to represent only their donors and lobbyists.

paulsurovell said:

GOP plan: cut taxes on corporations and the wealthy, create a huge deficit, blame the deficit on Medicare, Medicaid and Social Security and proceed to cut those programs.

The attacks on America's social safety net start in 2018:

http://thehill.com/homenews/house/363642-ryan-pledges-entitlement-reform-in-2018

I brought something like this up previously. The mugging of the elderly. I thought they would wait a few years until the deficit becomes obvious. Silly me.

https://maplewood.worldwebs.com/profile/comments/u/bg9?page=next&limit=12#discussion-replies-3380414

ps - https://www.nytimes.com/2017/12/04/opinion/republican-tax-bill-benefits.html

nohero said:

paulsurovell said:It was all in the plan in the 2016 election.

GOP plan: cut taxes on corporations and the wealthy, create a huge deficit, blame the deficit on Medicare, Medicaid and Social Security and proceed to cut those programs.

The attacks on America's social safety net start in 2018:

http://thehill.com/homenews/house/363642-ryan-pledges-entitlement-reform-in-2018

It started long before 2016

ml1 said:

It's really striking how undemocratic this process has been. The Republicans in Congress are ramming this bill through over the objections of even their own voters.

The country is now in a place where Congress and the White House don't even need to be responsive to their own constituents. Most Republican voters only care about keeping Democrats out of office at all costs. As a result, Congress is free to represent only their donors and lobbyists.

As much as I loathe tax increases and the amount of taxes I pay, this is what really bothers me about this process and the state of U.S. politics today. It's not about doing the right thing, its about sticking it to the "other" guy.

For Sale

-

leather couches $300

More info

Garage Sales

-

Multi Family Garage Sale Sale Date: Apr 20, 2024

More info

Free Items

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

This is worse then the Flynn guilty plea - but seems like they'll be happy with the distraction. ugh