Tariffs announcement and impact on stock market

jamie, any chance you could update the thread title? The current title gives me a little yip every time i see it.

I wasn't paying close attention today. I saw the market was down a couple of hundred points early on, went to a meeting for an hour, came out and it was down about 600.

I had read somewhere that the 400 point drop was due to concerns over the inverted yield curve...but was that drop actually after Trump's tweet?

The computers are in charge anyway.

sbenois said:

I wasn't paying close attention today. I saw the market was down a couple of hundred points early on, went to a meeting for an hour, came out and it was down about 600.

I had read somewhere that the 400 point drop was due to concerns over the inverted yield curve...but was that drop actually after Trump's tweet?

The computers are in charge anyway.

There was a massive reallocation by the risk parity hedge funds, like Bridgewater. They sold massive amounts of stock and bought bonds - the best way to see what happened is to compare the 3.2% loss in the S&P to the 1.68% gain in the 20+Year Treasury Bond Fund TLT.

We haven't seen a move like this, from stocks into bonds, in a long time.

Not seeing any real follow through in Tokyo tonight which is surprising to me because our markets are closed tomorrow. I would have expected a deep selloff there.

One guy who has been calling it right all year is Mike Wilson, of Morgan Stanley. He now sees an earnings recession in 2019.

https://www.morganstanley.com/ideas.html

Liz Ann Sanders, of Charles Schwab, has been extremely cautious on the market all year.

Huawei's CFO arrested:

https://www.bbc.com/news/business-46465768

Dow drops another 600+ points. With Trump in office, I don't see stability returning to the market anytime soon.

jamie said:

Huawei's CFO arrested:

https://www.bbc.com/news/business-46465768

Dow drops another 600+ points. With Trump in office, I don't see stability returning to the market anytime soon.

I understand, late as it is there, many lights are on in Huaien Hall. Its not smart to impede or threaten a princeling.

jamie said:

Huawei's CFO arrested:

https://www.bbc.com/news/business-46465768

Dow drops another 600+ points. With Trump in office, I don't see stability returning to the market anytime soon.

I really want to believe that the implications of ordering her arrest were carefully weighed in the Trump Administration, but I can't.

tjohn said:

jamie said:I really want to believe that the implications of ordering her arrest were carefully weighed in the Trump Administration, but I can't.

Huawei's CFO arrested:

https://www.bbc.com/news/business-46465768

Dow drops another 600+ points. With Trump in office, I don't see stability returning to the market anytime soon.

Bolton said he was aware of Meng's arrest in advance but is not sure if Trump was aware of it in advance.

eta - Nothing yet about whether Lighthizer knew in advance.

This is why the market finished strong:

"Fed officials are considering whether to signal in December a new wait-and-see approach that could slow the pace of rate increases next year"

https://twitter.com/WSJ/with_replies?lang=en

Or, we can go with The Onion:

https://www.theonion.com/financial-experts-say-stock-market-constantly-plunging-1830913240

Financial Experts Say Stock Market Constantly Plunging, Reaching Record Highs, Leading Indicator Of Healthy Economy

NEW YORK—Reminding investors that 800-point swings are completely normal, financial experts confirmed Thursday that the stock market constantly plunging before climbing to record highs was the leading indicator of a healthy economy. “A highly volatile market that reaches a record high one day before suddenly wiping out weeks’ worth of gains the next is a defining characteristic of a robust economy,” said Standard & Poor’s chief global economist, Paul Gruenwald, who urged investors to remain calm and continue buying up stocks before dumping everything the instant the Dow dropped. “We’re right in the middle of what we call an Everest/Mariana Trench pattern, and that’s exactly the kind of wild oscillation you want to see across all markets. Investors everywhere should consider this an opportunity to either make or lose a huge sum of money.” At press time, financial experts were beginning to panic after trade talks between America and China caused the market to briefly stabilize.

Bloomberg is reporting that China is said to be moving towards cutting the tariff on cars made in the U.S. from the current 40% to 15%. A proposal has been submitted to China's Cabinet to be reviewed in the coming days. U.S. stock futures are up big.

cramer said:

Bloomberg is reporting that China is said to be moving towards cutting the tariff on cars made in the U.S. from the current 40% to 15%. A proposal has been submitted to China's Cabinet to be reviewed in the coming days. U.S. stock futures are up big.

https://www.bloomberg.com/news/articles/2018-12-11/china-is-said-to-move-on-u-s-car-tariff-cut-trump-tweeted-about?srnd=premium

What is the size of the market in China for U.S. made cars? Is this one of those deals where China looks reasonable, Trump can crow like a rooster and the actual benefit for U.S. workers is minor? The only thing I can tell from the article is that BMW and Daimler will benefit nicely.

Brutal. Even the utilities are being sold today - they were the safe haven.

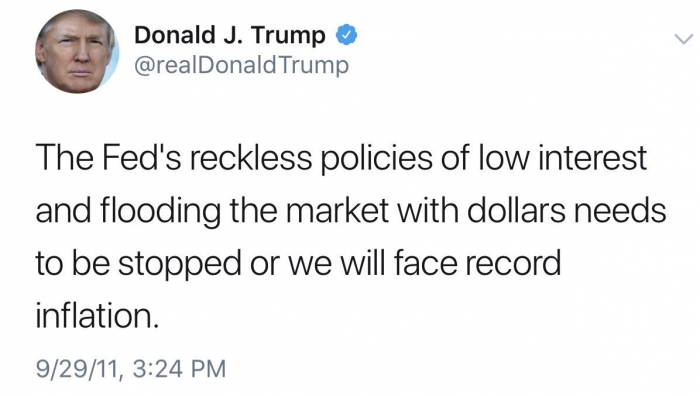

And now he's whining about his appointee.

Does he not remember that it was he who appointed the Fed Chair? Prematurely replacing Janet Yellen who was much more dovish on raising interest rates?

There's been a lot of talk about how it would have been better to keep your money in a mattress. I follow several market pro's (some would argue with that description) on my Twitter feed. I've been getting an ad for Casper Mattresses on my feed.

cramer said:

There's been a lot of talk about how it would have been better to keep your money in a mattress. I follow several market pro's (some would argue with that description) on my Twitter feed. I've been getting an ad for Casper Mattresses on my feed.

Does Casper say it comes with a convenient zipper for easy withdrawals? If not, I wouldn't buy it.

cramer said:

One guy who has been calling it right all year is Mike Wilson, of Morgan Stanley. He now sees an earnings recession in 2019.

https://www.cnbc.com/2018/11/26/morgan-stanley-strategist-who-predicted-sell-off-sees-dismal-2019.html

https://www.morganstanley.com/ideas.html

Liz Ann Sanders, of Charles Schwab, has been extremely cautious on the market all year.

Mike Wilson is a guest on CNBC Half-time. Worth a listen.

eta - Wilson has been right on the market all year and is now a bit more positive and they're arguing with him.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

For Sale

Garage Sales

-

Multi Family Garage Sale Sale Date: Apr 20, 2024

More info

Having seen Trump in action and considering his tweets, I realize, that Trump among many other things has shown us he is incredibly stupid.

But, I'm not so sure about all his advisors. Maybe some are whereas others are playing him. Manipulating the Dotard to put out Tweets that affect the markets. Which is extremely enriching to to those playing the options and commodities markets.