A Trillion here, a Trillion there...sooner or later you're talking about real $$

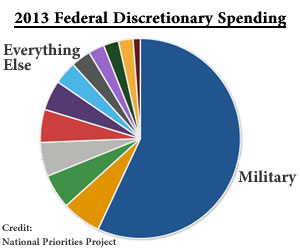

They don't care. They get too much money anyway. Cut the DOD budget in half and maybe they will take better care of the accounting.

wedjet said:

They don't care. They get too much money anyway. Cut the DOD budget in half and maybe they will take better care of the accounting.

But look at how well defended we are! Nothing ever happens to us.

Once again the ones to blame are we the people. How many voters are going to demand that our representatives drastically cut the defense budget? Especially in districts with bases or defense factories?

ml1 said:

Once again the ones to blame are we the people. How many voters are going to demand that our representatives drastically cut the defense budget? Especially in districts with bases or defense factories?

I'd say its approximately the amount of people who supported Ron Paul. Well, its a start!

terp said:

ml1 said:

Once again the ones to blame are we the people. How many voters are going to demand that our representatives drastically cut the defense budget? Especially in districts with bases or defense factories?

I'd say its approximately the amount of people who supported Ron Paul. Well, its a start!

It's not just districts but states. With every state getting two votes in the Senate no matter how many people they have, the "people" don't all have an equal say in these things.

Could someone with a background in accounting comment on this story? When I first saw the headline, I got the impression that it was saying the army overspent by trillions of dollars. Reading the story, though, it doesn't actually seem to be about spending, but about improper accounting - dollars improperly tracked, or written in one account but actually payed to another - and that the "adjustments" to make these looks like they were properly tracked adds up to trillions?

I'm not an accountant, so could someone with actual knowledge weigh in -- is this the correct reading - that this is a story about poor accounting, but not necessarily about overspending?

Could be both. Not sure what the trillions are (and seemingly, neither do they) nor how counted.

For a VERY simplified example: if someone charges acct #123 ("Office Supplies") $1m for an invoice received from HD for screwdrivers, then moves it to acct #456 ("Tools") a month later, that's either 0 (net) $1m (principal) or $2m (gross) in adjustments. Doesn't mean the adj entry was wrong--in fact quite the opposite--but still counts in the figure somehow.

Related to that, they may have budgeted for and also (hopefully) accrued for the cost. If the accrual wasn't properly closed on the acct, or any difference between the accrued (expected) cost and the realized cost wasn't appropriately accounted for, there's another issue. Maybe that accrued cost for screwdrivers was closed out against a realized purchase of tires. When we're talking helicopters and tanks, and billion-dollar contracts spanning several years, the numbers get insane. Introduce the possibility of willful mismanagement (need another $10m for screwdrivers?... don't want to mess with appropriations folks?... hit the tank account or the general fund) then all hell breaks loose.

ctrzaska said:

Could be both. Not sure what the trillions are (and seemingly, neither do they) nor how counted.

For a VERY simplified example: if someone charges acct #123 ("Office Supplies") $1m for an invoice received from HD for screwdrivers, then moves it to acct #456 ("Tools") a month later, that's either 0 (net) $1m (principal) or $2m (gross) in adjustments. Doesn't mean the adj entry was wrong--in fact quite the opposite--but still counts in the figure somehow.

Related to that, they may have budgeted for and also (hopefully) accrued for the cost. If the accrual wasn't properly closed on the acct, or any difference between the accrued (expected) cost and the realized cost wasn't appropriately accounted for, there's another issue. Maybe that accrued cost for screwdrivers was closed out against a realized purchase of tires. When we're talking helicopters and tanks, and billion-dollar contracts spanning several years, the numbers get insane. Introduce the possibility of willful mismanagement (need another $10m for screwdrivers?... don't want to mess with appropriations folks?... hit the tank account or the general fund) then all hell breaks loose.

As someone who also isn't an accountant...what happens to a company and the individuals in the company if this kind of thing happens in the private sector?

Sometimes, sadly, just a slap on the wrist and then it gets papered over, if the person has enough political pull in the office. I've seen more egregious mismanagement and malfeasance condoned in the private sector.

terp said:

ctrzaska said:

Could be both. Not sure what the trillions are (and seemingly, neither do they) nor how counted.

For a VERY simplified example: if someone charges acct #123 ("Office Supplies") $1m for an invoice received from HD for screwdrivers, then moves it to acct #456 ("Tools") a month later, that's either 0 (net) $1m (principal) or $2m (gross) in adjustments. Doesn't mean the adj entry was wrong--in fact quite the opposite--but still counts in the figure somehow.

Related to that, they may have budgeted for and also (hopefully) accrued for the cost. If the accrual wasn't properly closed on the acct, or any difference between the accrued (expected) cost and the realized cost wasn't appropriately accounted for, there's another issue. Maybe that accrued cost for screwdrivers was closed out against a realized purchase of tires. When we're talking helicopters and tanks, and billion-dollar contracts spanning several years, the numbers get insane. Introduce the possibility of willful mismanagement (need another $10m for screwdrivers?... don't want to mess with appropriations folks?... hit the tank account or the general fund) then all hell breaks loose.

As someone who also isn't an accountant...what happens to a company and the individuals in the company if this kind of thing happens in the private sector?

ctrzaska said:

Could be both. Not sure what the trillions are (and seemingly, neither do they) nor how counted.

For a VERY simplified example: if someone charges acct #123 ("Office Supplies") $1m for an invoice received from HD for screwdrivers, then moves it to acct #456 ("Tools") a month later, that's either 0 (net) $1m (principal) or $2m (gross) in adjustments. Doesn't mean the adj entry was wrong--in fact quite the opposite--but still counts in the figure somehow.

Related to that, they may have budgeted for and also (hopefully) accrued for the cost. If the accrual wasn't properly closed on the acct, or any difference between the accrued (expected) cost and the realized cost wasn't appropriately accounted for, there's another issue. Maybe that accrued cost for screwdrivers was closed out against a realized purchase of tires. When we're talking helicopters and tanks, and billion-dollar contracts spanning several years, the numbers get insane. Introduce the possibility of willful mismanagement (need another $10m for screwdrivers?... don't want to mess with appropriations folks?... hit the tank account or the general fund) then all hell breaks loose.

Thanks for weighing in.

Welcome. Not a CPA so maybe not as technical as you need, but in banking and finance for a long while and I've had my direct hand in managing billion-dollar budgets... when you've seen one...

But seriously, to terp's point: I can't speak for anything but my sector, but it tends not to go over well, ever, but particularly in this climate. Last thing anyone wants (on a whole host of levels) is a material misstatement of earnings. The ramifications extend far beyond just an individual or two being shown the door and a slap on the wrist. Granted I'm closer to the "too-big-to-fail" requirements and the gazillions embedded in that reporting, but the financial and reputational risks are similar and HUGE on either front.

Featured Events

-

Stephen Whitty Presents - Hometown Movie Stars: The Celebrated Actors Of CHS

May 6, 2024 at 7:00pm

-

'Beethoven's Wrong Note: A Steampunk Opera'

May 12, 2024 at 2:00pm

U.S. Army fudged its accounts by trillions of dollars, auditor finds