GOP Sets Table For Eliminating Deduction of State and Local Taxes

LOST said:

Keeping the Property Tax deduction but eliminating the Income Tax reduction hurts renters including many senior citizens who have sold their houses and downsized.

I'm lost.

How does it hurt renters to retain the property tax deduction which is not relevant to them? Losing their deduction for state income tax paid may hurt, depending on the amount of paid state income tax.

Keeping the property deduction will help those who have houses and have limited pension and soc sec income.

Runner_Guy said:

The GOP attempt to eliminate the SALT deduction doesn't surprise me, but preserving the property tax deduction does.

I'm not. NAHB.

BG9 said:

LOST said:

Keeping the Property Tax deduction but eliminating the Income Tax reduction hurts renters including many senior citizens who have sold their houses and downsized.

I'm lost.

How does it hurt renters to retain the property tax deduction which is not relevant to them? Losing their deduction for state income tax paid may hurt, depending on the amount of paid state income tax.

Keeping the property deduction will help those who have houses and have limited pension and soc sec income.

Runner_Guy said:

The GOP attempt to eliminate the SALT deduction doesn't surprise me, but preserving the property tax deduction does.

I'm not. NAHB.

I guess I was less than clear. Keeping the property tax deduction does not hurt renters. Eliminating the income tax deduction hurts everyone.

Dirt roads would help slow down the speeders.

ml1 said:

wedjet said:

Eliminating these deductions is an attempt at really sticking it to states that try to raise revenue to provide services and pay public sector workers a fair wage. It's ideological for these Republicans. They hate that any states are trying to make life more livable for its residents. They'd like everyone to live in toxic hell holes with dirt roads and schoolbooks from 1970. F them. Why should it be any business of theirs what NJ or MA or CA or NY wants to pay its school teachers?

It's funny that you should mention dirt roads. Wisconsin is going back to some gravel roads to save money.

https://www.wpr.org/small-wisconsin-towns-paved-roads-return-gravel

It was no coincidence I chose that term. A lot of states are tearing up their roads because they don't have the funds to maintain them. It looked for awhile like we might have got to that point in NJ, with Christie refusing to sign off on a gas tax increase.

Renters in NJ can get a property tax deduction on their income tax return.

Just like health care, the GOP has been screaming for "tax reform" for years. Now we see that, once again, they don't have a plan. They're just "spitballing", tossing out thoughts without considering what it costs, who gets screwed, and if the numbers add up.

South_Mountaineer said:

Just like health care, the GOP has been screaming for "tax reform" for years. Now we see that, once again, they don't have a plan. They're just "spitballing", tossing out thoughts without considering what it costs, who gets screwed, and if the numbers add up.

But it works. They keep being elected.

The word from a reporter inside the House who has seen leaks of what to expect is that the property tax deduction will be allowed up to $10,000. Thanks a lot, Republicans. The average tax bill in South Orange is $18,000.

Considering that the standard deduction for married couples is going to be increased to $24,000, that does nothing, unless your mortgage and charitable contributions are greater than $14,000.

cramer said:

The word from a reporter inside the House who has seen leaks of what to expect is that the property tax deduction will be allowed up to $10,000. Thanks a lot, Republicans. The average tax bill in South Orange is $18,000.

Considering that the standard deduction for married couples is going to be increased to $24,000, that does nothing, unless your mortgage and charitable contributions are greater than $14,000.

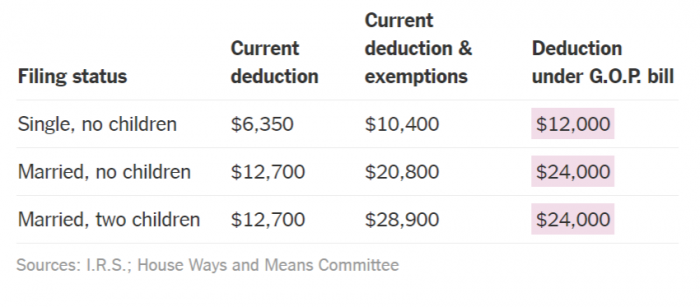

Aren't they planning to remove the personal exemption? That would, for many, wipe out or seriously reduce the standard deduction increase.

http://www.latimes.com/business/la-fi-trump-taxes-standard-deduction-20170928-story.html

But no matter what, if you itemize you can't take the standard deduction. So, if your mortgage interest, property tax and charitable deductions are greater than 24,000, you will itemize but you will have lost the income tax deduction and the personal exemption.

Itemizing will make the standard deduction increase meaningless. The only effect to itemizers being they lose their income tax deduction and limit their property tax deduction to 10,000. This will hurt the middle class even in towns that don't have high property taxes. This will hurt.

Gotta feed their constituency, the really rich.

To summarize:

An increase of the standard deduction to 24,000.

A loss of the personal exemptions.

A loss of the state and local income tax deductions.

A limiting of the property tax deduction to 10,000.

Sara Eisen of CNBC is interviewing Grover Norquist. She said that a lot of people in the states on both coasts are going to be hurt by limiting the property tax deduction to $10,000. Grover said that the jobs created by reducing the corporate tax rate to 20% are going to be a plus (a non-answer.) Then he said "sure, a lot of people are going to be hurt in the cities on the east coast where there are high property taxes because of corruption."

Home builder stocks are down because with the limitation of the property tax deduction to $10,000, most people will not be taking the mortgage interest deduction since they will be taking the standard deduction of $24,000 instead of itemizing.

cramer said:

Grover said that the jobs created by reducing the corporate tax rate to 20% are going to be a plus (a non-answer.) Then he said "sure, a lot of people are going to be hurt in the cities on the east coast where there are high property taxes because of corruption."

Yeah, sure.

Brownback said the same when he reduced taxes. He promised an economic miracle. Kansas got its miracle but not in the direction they expected.

It amazing how the Republicans can sell their same proven discredited crap over and over and still have large segments of the public buying in.

It would be interesting to get the perspective of local Trump supporters who have large homes with property tax bills that far exceed $10,000.

I think its possible for those who used a program like Turbo tax to easily figure out what the new tax plan costs. This assuming tax rate tables will remain the same.

Go to Turbo tax and open last last year's return. Save it under another name. Adjust the return to remove the personal exemptions, the state income tax deduction and change the property tax deduction to 10,000. Have it then recalculate your tax.

If you used the standard deduction, lower your income by 11,400 to simulate the standard deduction being increased from 12,600 to 24,000. Remove your personal exemptions. Recalculate your tax.

ska said:

The tax rate table will not be the same.

That's an easy adjustment. Do the above to get your new taxable income and then manually use the new tax tables to calculate your tax.

cramer said:

Sara Eisen of CNBC is interviewing Grover Norquist. She said that a lot of people in the states on both coasts are going to be hurt by limiting the property tax deduction to $10,000. Grover said that the jobs created by reducing the corporate tax rate to 20% are going to be a plus (a non-answer.) Then he said "sure, a lot of people are going to be hurt in the cities on the east coast where there are high property taxes because of corruption."

What a lying stooge. He's been to cities, and he's been to cornfields, and he understands the infrastructure differences.

This table shows the effect losing the personal exemption has. It mostly cancels the doubling of the standard deduction. And those of you, who itemize, its really another deduction loss besides the property tax deduction limit and income tax deduction loss.

so, it seems to benefit 2 of the 3 lines on your table. What about single with 2 children? Probably a wash in that case, right?

If you didn't live in a super high property tax state, wouldn't this be a benefit to most? Is there an income cap on claiming the $24,000 standard deduction?

Personally for us with no kids, I think the $24k is just about a wash with our itemized deductions. Maybe slightly lower than what we itemize. But in all honestly, if this helps most people, I'm okay with paying a little more.

Details are emerging..

The plan establishes three tax brackets, 12, 25 and 35 percent, and also keeps a top rate of 39.6 percent for the highest-earners, collapsing the total number of brackets from seven. The brackets fall along the following lines:

Those making up to $24,000 will pay no income tax. For married taxpayers filing jointly, earnings up to $90,000 will be in the 12 percent bracket; earnings up to $260,000 will fall in the 25 percent bracket and earnings up to $1 million would be taxed at the 35 percent rate. Those making above $1 million will fall in the 39.6 percent bracket, which is currently the top rate for millionaires. For unmarried individuals and those filing separately, the bracket thresholds would be half of these amounts, other than the 35 percent bracket, which would be $200,000 for unmarried individuals.

Wow. This is bad.

The Republicans promote adoption as an alternative to abortion, but they are getting rid of the adoption tax credit?

Making disabled people pay more is bad too.

The bill includes a host of changes that will impact taxpayers in different ways. For instance, it repeals certain tax credits, including a 15 percent credit for individuals age 65 or older or who are retired on disability. Right now, those individuals can claim up to $7,500 for a joint return, $5,000 for a single individual, or $3,750 for a married individual filing a joint return.

The House bill would entirely repeal that tax credit. It would also repeal the adoption tax credit, no longer allow deductions for tax preparation and repeal credits for alimony payments. And deductions for moving expenses would no longer be allowed.

I think this is actually good.

Other parts of the plan would limit or eliminate some tax breaks corporations currently employ. It limits the deductibility of interest for most companies, for example, with an exception for smaller firms. It would also take away businesses’ ability to deduct some types of executive compensation above $1 million a year — including performance-based pay.

Doesn't the private equity industry exploit the deductibility of debt?

And the cap on exec compensation is good too.

Runner_Guy said:

Details are emerging..

The plan establishes three tax brackets, 12, 25 and 35 percent, and also keeps a top rate of 39.6 percent for the highest-earners, collapsing the total number of brackets from seven. The brackets fall along the following lines:

Those making up to $24,000 will pay no income tax. For married taxpayers filing jointly, earnings up to $90,000 will be in the 12 percent bracket; earnings up to $260,000 will fall in the 25 percent bracket and earnings up to $1 million would be taxed at the 35 percent rate. Those making above $1 million will fall in the 39.6 percent bracket, which is currently the top rate for millionaires. For unmarried individuals and those filing separately, the bracket thresholds would be half of these amounts, other than the 35 percent bracket, which would be $200,000 for unmarried individuals.

https://www.nytimes.com/2017/11/02/us/politics/tax-plan-republicans.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=a-lede-package-region®ion=top-news&WT.nav=top-news

Admittedly a very quick look, but so far this looks good to me. Makes sense. Seems to not just benefit the super- wealthy.

I'm okay with all of this except the repeal of the adoption credit. I'm not sure I understand the 15% elder/ disabled tax credit or how it works currently. Will something else be put in place to benefit these groups?

Runner_Guy said:

Wow. This is bad.

The Republicans promote adoption as an alternative to abortion, but they are getting rid of the adoption tax credit?

Making disabled people pay more is bad too.

The bill includes a host of changes that will impact taxpayers in different ways. For instance, it repeals certain tax credits, including a 15 percent credit for individuals age 65 or older or who are retired on disability. Right now, those individuals can claim up to $7,500 for a joint return, $5,000 for a single individual, or $3,750 for a married individual filing a joint return.

The House bill would entirely repeal that tax credit. It would also repeal the adoption tax credit, no longer allow deductions for tax preparation and repeal credits for alimony payments. And deductions for moving expenses would no longer be allowed.

There is a huge swath of the middle class that gets no tax rate decrease ($90,000 - $153,100 married filing jointly) and with the reduction or elimination of many deductions I'm not sure how this is that beneficial. Maybe you save $1000 - $2000 annually if your itemized deductions are lower than the new standard deduction?

The largest beneficiaries are those making $470,700 - $1,000,000 (married filing jointly).

I have a very low income relative and this means a much larger amount of her $ will stay in her pocket.

Also, I'm guessing that for that middle group you describe, the shift to a $24k standard deduction will be much higher that what they get now and result in a few thousand back to them even though their income tax rate will essentially stay the same at 25%

Child tax credit will go from $1,000 to $1,600 per child which can also be important to many.

And, yes, I agree the greatest beneficiary will be the highest income.

The doubling of the standard deduction is almost completely washed by the elimination of the personal exemption. This is all smoke and mirrors to confuse the rabble and distract from the fact that this is yet another huge giveaway to the rich.

The GOP is also going to cap mortgage interest at $500,000 for new mortgages.

This would also increase taxes on the upper-middle class and hurt high-cost parts of the US. It would reduce resale value for incumbent homeowners. On the other hand, the mortgage interest deduction is regressive anyway.

https://www.vox.com/policy-and-politics/2017/11/2/16597942/republican-tax-plan-mortgage-deduction

The Republicans certainly have guts. I cannot think of a time the Democrats have gotten behind any bill this disruptive. The Democrats passed the ACA with the support of the healthcare interest groups. What the Republicans are doing is the equivalent of the Democrats setting up single-payer healthcare.

The increase in the Standard Deduction helps those with no dependents and low deductions. But removing the exemption hits families with children and pretty quickly cancels out the change in the Standard Deduction. I don't know why this isn't being said more loudly like the SALT elimination, which targets states like ours and is more easily ignored by many in other states ... but they all have families with children who aren't going to see that much, if any, improvement.

So what's the likelihood of this passing as is?

For example, how is this going to fly with the Republican "Pro-Life" base?

Runner_Guy said:

Wow. This is bad.

The Republicans promote adoption as an alternative to abortion, but they are getting rid of the adoption tax credit?

And where are they going with this:

Runner_Guy said:

Making disabled people pay more is bad too.

For Sale

Garage Sales

-

HUGE Rummage sale to benefit the Bloomfield High School Robotics Team Sale Date: Apr 27, 2024

More info

We will need to go back to rail barges across the Hudson, thanks to Christie.