Connecticut's Democratic Governor Gives Up on Tax Increases

FYI, interesting context about Kansas.

First, the 2012 tax cuts came during the same year that federal stimulus funds ended. That alone resulted in a 12.5% drop in revenue. In the spring of 2010, then-Gov. Mark Parkinson, a Democrat, had worked with the Legislature to pass a 2011 budget that included $527.6 million in stimulus funds. Democrats knew this money was temporary but behaved as if it were permanent. The effect was to exaggerate the "lost revenue" from the tax cut.

Second, the shortfall was made worse because state lawmakers rejected the "pay-fors" proposed by Republican Gov. Sam Brownback. The governor's original tax plan would have closed many loopholes. But the Legislature wanted to keep the tax credits and deductions and left them in the final bill. Such carve-outs should be viewed as spending through the tax code, as Martin Feldstein, a top adviser to President Reagan, has argued on these pages.

Third, the Legislature then continued to increase spending by 3% a year. Between the 2010 and 2018 budget years, during this era of supposedly devastating cuts caused by right-wing tax policy, lawmakers raised expenditures from $5.3 billion to $6.6 billion. Democrats who deride the Kansas "experiment" conveniently ignore how spending contributed to the fiscal problem.

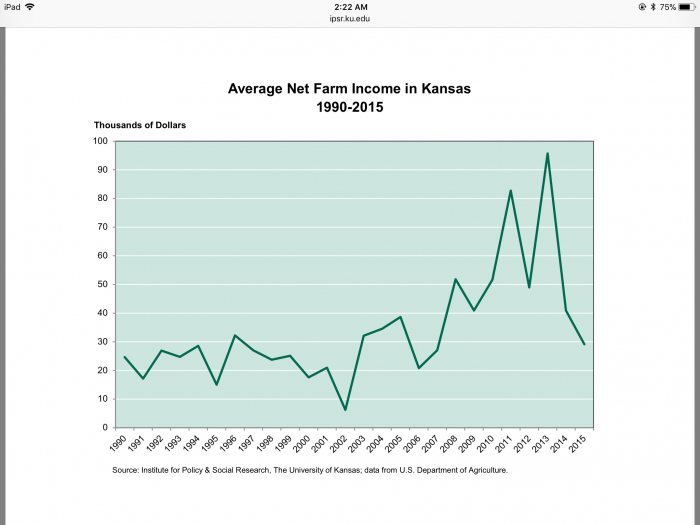

Fourth, after 2012 Kansas faced economic headwinds that decreased revenue. As commodity prices sank, the average net farm income in Kansas collapsed, from $159,352 in 2012 to $4,568 in 2015. Aviation companies -- Kansas is home to Spirit AeroSystems, Cessna and Bombardier Learjet -- struggled in the economic downturn caused by the Great Recession. Meanwhile, plunging oil and gas prices hurt drillers in central and western Kansas. For the state treasury, this was a perfect storm.

https://www.wsj.com/articles/the-democrats-kansas-distraction-1510701710

Runner_Guy said:

FYI, interesting context about Kansas.

“First, the 2012 tax cuts came during the same year that federal stimulus funds ended. That alone resulted in a 12.5% drop in revenue. In the spring of 2010, then-Gov. Mark Parkinson, a Democrat, had worked with the Legislature to pass a 2011 budget that included $527.6 million in stimulus funds. Democrats knew this money was temporary but behaved as if it were permanent. The effect was to exaggerate the ‘lost revenue’ from the tax cut.”

In the first full fiscal year (2014) of the Kansas tax cuts, state tax revenue fell 11 percent — from fiscal 2013, which was already post-stimulus. Also, do you see that $527.6 million figure for lost stimulus funding reported anywhere else? I can’t find it. (But, again, state tax revenue was $700 million less in fiscal 2014 than it was in post-stimulus 2013.)

ETA: And was anybody really conflating lost federal aid with lost tax revenue when tallying (a.k.a. “exaggerating”) the costs of the tax cuts?

“Second, the shortfall was made worse because state lawmakers rejected the ‘pay-fors’ proposed by Republican Gov. Sam Brownback. The governor's original tax plan would have closed many loopholes. But the Legislature wanted to keep the tax credits and deductions and left them in the final bill. Such carve-outs should be viewed as spending through the tax code, as Martin Feldstein, a top adviser to President Reagan, has argued on these pages.”

The Republican Party has controlled both chambers of the Legislature since 1993.

“Third, the Legislature then continued to increase spending by 3% a year. Between the 2010 and 2018 budget years, during this era of supposedly devastating cuts caused by right-wing tax policy, lawmakers raised expenditures from $5.3 billion to $6.6 billion. Democrats who deride the Kansas ‘experiment’ conveniently ignore how spending contributed to the fiscal problem.”

Same question as my Oct. 29 post: Was this really a steady rise, or is this just “It was X in 2010 and it’s Y now, and to get from X to Y requires 3 percent annual increases”? Also, the Republican Party has controlled both chambers of the Legislature since 1993.

“Fourth, after 2012 Kansas faced economic headwinds that decreased revenue. As commodity prices sank, the average net farm income in Kansas collapsed, from $159,352 in 2012 to $4,568 in 2015.”

The chart below has different figures than the Journal piece, but it suggests that the “storm” was the spike, not the drop back to historical norms.

even if all of those headwinds suggested in the article were real, that argument ignores one very salient aspect of the Kansas tax cutting experiment -- Brownback used the always-bogus and always-discredited argument that the tax cuts would pay for themselves. That can't happen, and never does happen. And if all of those other pressures on revenue were in effect, tax cutting was an even dumber response.

the criticism and the ridicule that Brownback and the Kansas GOP have received are entirely appropriate. The tax cuts were sold via the same old snake oil.

Given the recent Senate vote, just want to resurrect this thread to note how, again, we have proof that "fiscal conservatives" don't actually care about the deficit. I suppose it's possible that the OP here genuinely does, but if so that's just a personal idiosyncrasy that has no bearing or relevance to American politics or government. Whenever someone starts up about the dangers of the deficit, and how this leaves us no choice but to cut spending and give the wealthy a tax break, we can safely dismiss such talk as being complete and utter bs.

1. The Kansas article I posted would be among the least-persuasive things I've ever posted on MOL, although my assumption is that the author wasn't lying about everything, so it is an interesting context in some ways, like the overall increase in spending.

The author's complaint that the people who deride Kansas ignore the spending side I think applies to arguments about New Jersey's own fiscal disaster.

Most people blame the Whitman tax cuts for NJ's crisis, but during Whitman's years state spending rose from $12 billion a year to $20 billion, so there is a tremendous spending-side contributor to NJ's deep problems.

Anyway, I should have kept the conversation to Connecticut and New Jersey.

2.

I suppose it's possible that the OP here genuinely does, but if so that's just a personal idiosyncrasy that has no bearing or relevance to American politics or government.

I agree that the Republican tax cut reveals (yet again) that the Republicans have no sincere worry about the US deficit. Their denunciations of Democratic presidents for increasing the deficit were just opportunistic attacks on spending.

That being said, I think people have a lot more valid reasons to worry about a NJ's debts and taxes than they do the national debt.

NJ is small enough that people can leave rather easily compared to leaving the United States. NJ can't print its own money through "Qualitative Easing" and then borrow in that self-created money. The United States actually has low taxes compared to other Western countries, but New Jersey's taxes are already the 1-2 worst in the US.

The US government has big debts for Medicare and Social Security, but those are statutory entitlements that Congress has the legal ability to cut. New Jersey, by contrast, does not have the legal ability to reduce its pension obligations. (although we do have the legal ability to cut post-retirement healthcare and most of our non-pension debt.)

If a national Republican predicts the sky is falling because of the federal debt, don't believe him, but don't forgive the NJ Republicans for not screaming even more loudly about the vicious spiral we are getting sucked into.

Runner_Guy said:

1. The Kansas article I posted would be among the least-persuasive things I've ever posted on MOL ...

If you say so. Regretfully (because I had always taken your information and comments about N.J. school funding seriously), I’m done caring about what you post.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

For Sale

Garage Sales

-

HUGE Rummage sale to benefit the Bloomfield High School Robotics Team Sale Date: Apr 27, 2024

More info

Interesting data point added by that OLS report: The share of income tax paid by filers earning more than $500,000 was 37.8 percent in 2000. The GSI report says it fell to 29.5 percent two years later, then was up again, to 40.2 percent in 2014.

Can you document that an “increasing reliance” on high earners is a trend that continued, rather than a rate that’s been fluctuating year to year? (I’ll concede the other trend: that revenue crashes during recessions.)