A wall-streeter says tax the wealthy archived

johnlockedema said:

Of course, you do know without cutting entitlements the extra money raised by the Obama tax increases will be enough to run the government for 8 days (by the CBO).

Some plan!

Your GOP talking point didn't pass the Pinocchio test, though I'm sure you'll continue to repeat it ad nauseum.

http://www.washingtonpost.com/blogs/fact-checker/post/the-gops-claim-that-a-tax-hike-on-the-wealthy-would-pay-for-only-a-week-of-spending/2012/11/27/5218c26e-344c-11e2-9cfa-e41bac906cc9_blog.html?hpid=z1

So the 'make the rich pay their fair share' really is a feel good, throw meat to the faithful sop rather than a solution to anything. But we knew that.

You seem to deride any proposal from the Left that does not cover the entire deficit.

rastro said:

John, why is the number of days of spending that the increase covers relevant? how many days need to be covered by additional revenue or spending cuts?

You seem to deride any proposal from the Left that does not cover the entire deficit.

The 'make the rich pay their fair share' dog and pony show, to throw some fresh meat to Obama's supporters, accomplishes nothing-except throwing some fresh meat to his supporters.

Grinding down the national debt to a manageable level will take years. But this tax increase doesn't do a thing. We need a comprehensive approach, and even Obama has admitted (indeed endorsed) doing just that. So why aren't the Democrats willing to work in a bi-partisan manner to get that done?

Because their voters want to keep all the entitlements!

Pennboy:

"Everyone seemed to miss my point: Do I have no "human right" to the product of my labor? If what some of the Democrats are asking for gets adopted, many people in California will have marginal tax rates over 50%. Do they not have a right to keeping more of what is theirs than the government? What of those human rights?

The top 5% of wage earners pay 59% of the income tax in this country. When is it enough for some people?

Where do you look to history to say that your socialist ideas are good public policy?"

Everything that's wrong with this argument can be gleaned from the sentence:

'The top 5% of wage earners pay 59% of the income tax in this country.'

The top 5% are not the top wage earners . They are the people with the most wealth . And wealth, as everybody knows, is not created by relying on the fruits of your own labor. It is created by extracting profits from other people's labor . This is why rich people do not get rich by tending their vegetable garden. They get rich by employing other people, and extracting profit from their labor.

Pennboy is struggling intellectually with the difference between a simple society of self-subsistent vegetable growers,and a massive, complex, interdependent, industrial society, in which all labor is social labor, not individual provision for subsistence. When I say it's 'social' labor, I mean there are all kinds of social conditions that pre-exist and pre-determine the appearance of the worker at the workshop. These include things like health care, education, enculturation, etc. All of these things are social. And they form part of the costs of labor, costs which are not paid in wages, but rather in taxation so that society can generate the next generation of laborers.

When labor is always and of necessity social labor, the comment about a 'human right' to the product of your labor does not make sense, because if you employ other people, the 'product' of your labor will include the hidden social costs of labor, as well as (the largest part) the product of the labor of other people that is extracted as profit.

What does this have to do with my post? It's certainly not a response.johnlockedema said:

rastro said:

John, why is the number of days of spending that the increase covers relevant? how many days need to be covered by additional revenue or spending cuts?

You seem to deride any proposal from the Left that does not cover the entire deficit.

The 'make the rich pay their fair share' dog and pony show, to throw some fresh meat to Obama's supporters, accomplishes nothing-except throwing some fresh meat to his supporters.

Grinding down the national debt to a manageable level will take years. But this tax increase doesn't do a thing. We need a comprehensive approach, and even Obama has admitted (indeed endorsed) doing just that. So why aren't the Democrats willing to work in a bi-partisan manner to get that done?

Because their voters want to keep all the entitlements!

John, why is the number of days of spending that the increase covers relevant? how many days need to be covered by additional revenue or spending cuts?

rastro said:

What does this have to do with my post? It's certainly not a response.

John, why is the number of days of spending that the increase covers relevant? how many days need to be covered by additional revenue or spending cuts?

Since we can only mine data from what we've seen vis a vis new taxes I can't answer. Once we get some proposals on what entitlement cuts can be made we could then have answers.

But it's not about how many days the government can run-the example I gave just illustrates how useless the tax increases are. For Obama, it's all about the optics-he knows it will satisfy his base to have them see the earners get taxed more.

You acknowledge that revenue and cuts need to be part of it. You obviously understand that it will take more than any one spending cut or revenue increase. So your vehemence about this point is puzzling.

johnlockedema said:

But it's not about how many days the government can run-the example I gave just illustrates how useless tax increases are. For Obama, it's all about the optics-he knows it will satisfy his base to have them see the earners get taxed more.

It does not illustrate anything, since its completely irrelevant.

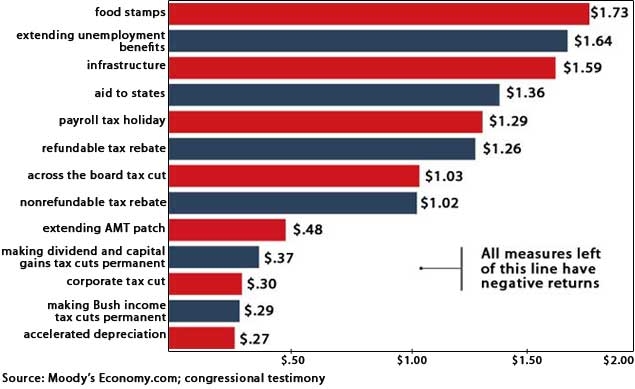

I'll give you some math to ponder. It's not relevant either, but at least it has context.

Our deficit is about 25% of spending. We need to cover about 90 days of spending with revenue increases if we were only going to use revenue increases to cover the deficit (which no one has proposed). So this proposal would reduce the number of days of operations to cover by about 8%. Sounds like a start. Throw in a few spending cuts for another 25%, some other revenue increases, and the deficit is cut by a big chunk.

You seem to think this tax increase is the one and only thing on the table. Why is that?

Nations are NOT households and their economies likewise differ.

johnlockedema said:

You're right, because it accomplishes nothing except to throw a bone to his base.

Do you even read? It cuts about 8% of the deficit.

Let's play your game of hypotheticals. If the Republicans proposed one (of several) spending cuts that totaled 70-80 billion/year, you'd be crowing about it as a good start. Hell, if they proposed a $500 million cut to public broadcasting (a 0.05% dent in the deficit), you'd be calling it a welcome reduction.

I have a question. Correct me if I'm wrong, which is highly possible, but the ticket you supported in the election, JLD, went out on the stump with a series of proposals which cut taxes and increased spending in some places and decreased some in others and which Paul Ryan claimed to be "revenue neutral". Doesn't "revenue neutral" mean that we would spending as much as we are taking in and vice versa?

If so, with that revenue neutral Romney/Ryan plan, how were we supposed to pay off this thing that was hanging up in full view of the Republican National Convention?

If you and I are the only taxpayers, and your taxes go up $1,000 and mine go down $1,000, to the government, that's revenue neutral.

Assuming that's correct, if the tax changes are revenue neutral but there are cuts to spending, the deficit will go down. Now, to get to debt reduction, they'd need to cut the entire deficit from the spending side.

rastro said:

johnlockedema said:

You're right, because it accomplishes nothing except to throw a bone to his base.

Do you even read? It cuts about 8% of the deficit.

Let's play your game of hypotheticals. If the Republicans proposed one (of several) spending cuts that totaled 70-80 billion/year, you'd be crowing about it as a good start. Hell, if they proposed a $500 million cut to public broadcasting (a 0.05% dent in the deficit), you'd be calling it a welcome reduction.

When did I ever say that? 70 billion a year doesn't do squat with a 16 trillion dollar debt, with 6 trillion added in the last few years, less than 2% growth, and a trillion plus dollar per year debt under Obama. When he said he'd halve that, no?

rastro said:

Actually, I think revenue nuetral just means we take in the same amount as we're taking in now. We just get it from different places.

If you and I are the only taxpayers, and your taxes go up $1,000 and mine go down $1,000, to the government, that's revenue neutral.

Assuming that's correct, if the tax changes are revenue neutral but there are cuts to spending, the deficit will go down. Now, to get to debt reduction, they'd need to cut the entire deficit from the spending side.

Interesting, and you are more than likely right, and as an innumerate this is why I try to stay out of the heavier economic threads.

I am speaking of the plan to grow the economy by getting government out of the way and lowering the tax rates [but not cutting taxes] in order to help small businesses .

You're probably going to respond that this is the same supply side nonsense that got us into this huge deficit mess in the first place. And you'd be right.

Tom_Reingold said:

pennboy2 said:

Everyone seemed to miss my point: Do I have no "human right" to the product of my labor? If what some of the Democrats are asking for gets adopted, many people in California will have marginal tax rates over 50%. Do they not have a right to keeping more of what is theirs than the government? What of those human rights?

The top 5% of wage earners pay 59% of the income tax in this country. When is it enough for some people?

Where do you look to history to say that your socialist ideas are good public policy?

pennboy, you brought gay rights and abortion here. I'm content if we leave them out of this discussion. sac's point was a response to you. I think she was trying to say that those topics are human-rights topics, not fiscal topics. Majority-rule is not a mechanism for determining human rights. Topic closed, OK?

Rights and duties go together. You do have a right to the product of your labor. That's why you have money. Where do you think you got it? You earned it.

You also have a duty to pay for things that society pays for collectively.

There is no amount or fraction that changes these principles. You get to keep everything you don't owe in taxes. Isn't that simple enough?

Electing representatives who determine tax levels is our system, and I think it's fine. Do you have a counter-proposal?

How is whom I can marry a human rights topic, but what happens to what I earn from my labor is not?

You know, socialist societies used to tell people what occupation they could enter into. Do you find that an infringement on human rights?

Do you find a marginal tax rate above 40% an infringement on human rights? 50%? 90%?

Or none of it matters so long as people vote for it?

How about we put up taking everything from billionaires over $1 billion? If people vote for that, is that OK in your book, Tom?

"There's a simple doctrine: outside of a person's love, the most sacred thing that they can give is their labor. And somehow or another along the way, we tend to forget that. Labor is a very precious thing that you have."

He's right. And yet all the libs can see is $$$$. Do they see any human right to this sacred thing? No, of course they don't, they're too busy trying to destroy American society with the politics of envy.

If 51% of the people say that we can take 99% of Mark Zuckerberg's labor from him, that seems to be good enough for them. What happened to human rights?

LET'S TAKE THEIR MONEY!!!!

Sick.

I say let's figure out all the things we can do and do them. Along the way, we'll figure out more things to do, and we'll do those, too.

pennboy2 said:

Tom_Reingold said:

Electing representatives who determine tax levels is our system, and I think it's fine. Do you have a counter-proposal?

How is whom I can marry a human rights topic, but what happens to what I earn from my labor is not?

You know, socialist societies used to tell people what occupation they could enter into. Do you find that an infringement on human rights?

Do you find a marginal tax rate above 40% an infringement on human rights? 50%? 90%?

Or none of it matters so long as people vote for it?

How about we put up taking everything from billionaires over $1 billion? If people vote for that, is that OK in your book, Tom?

Apparently he doesn't, Tom.

Tom_Reingold said:

JLD, you sound as if you're saying if we can't do everything, let's not do anything.

I say let's figure out all the things we can do and do them. Along the way, we'll figure out more things to do, and we'll do those, too.

Actually, Tom, I've suggested that Democrats give a $ number they want taxed, and let the Republicans offer a way come up with taxes (in any way, say close loopholes) to do that. And I've said Republicans should give a $ number they're comfortable limiting entitlements, and let the Democrats come up how to shrink it.

Then they should all meet over a beer to talk about it.

pennboy2 said:

How is whom I can marry a human rights topic, but what happens to what I earn from my labor is not?

You know, socialist societies used to tell people what occupation they could enter into. Do you find that an infringement on human rights?

Do you find a marginal tax rate above 40% an infringement on human rights? 50%? 90%?

Or none of it matters so long as people vote for it?

How about we put up taking everything from billionaires over $1 billion? If people vote for that, is that OK in your book, Tom?

You've asked many times what level of taxation is right. I don't have an answer for that, and neither do you. It's the wrong question.

I can think of two pertinent questions:

What do we as a society want?

How can we pay for it?

ridski said:

Tom_Reingold said:

Electing representatives who determine tax levels is our system, and I think it's fine. Do you have a counter-proposal?

Apparently he doesn't, Tom.

Clearly.

So I wonder who he thinks ought to come up with our taxation scheme. I can't even imagine who it should be other than elected officials.

johnlockedema said:

Actually, Tom, I've suggested that Democrats give a $ number they want taxed, and let the Republicans offer a way come up with taxes (in any way, say close loopholes) to do that. And I've said Republicans should give a $ number they're comfortable limiting entitlements, and let the Democrats come up how to shrink it.

Then they should all meet over a beer to talk about it.

I agree about the beer. Seriously.

Has either party taken your suggestion to heart?

Employment Wanted

Latest Jobs

Employment Wanted

-

Apr 24, 2024 at 1:13pm

-

****Laundry + Bedrooms Organization : closets,drawers,shelves

Apr 24, 2024 at 8:04am

-

Nomadic Notary: Professional Notary Services Available!

Apr 22, 2024 at 3:43pm

-

Apr 22, 2024 at 12:46pm

-

Apr 22, 2024 at 10:49am

Help Wanted

-

Part-time long term Nanny for toddler boy in Basking Ridge

Apr 24, 2024 at 7:49pm

-

PF802 FT M-Th Nanny for 2 (ASAP Start)

Apr 24, 2024 at 1:21pm

-

Photo Booth Attendant- Great for high school senior, college student, profeessional

Apr 24, 2024 at 5:55am

-

Part time Driving Sitter Needed (Start ASAP)

Apr 23, 2024 at 1:18pm

-

CKF600 Part Time Nanny for Toddler (ASAP Start)

Apr 22, 2024 at 3:21pm

Lessons/Instruction

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

Entitlement program need to be strengthened. But they should be off the table during these political, time bomb, lame duck Congressional sessions. Social security is not an emergency, even if you say it is because Fox News.